关于加密货币因素投资组合的(几乎)随机优势及其对加密货币资产定价的影响

IF 2.1

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

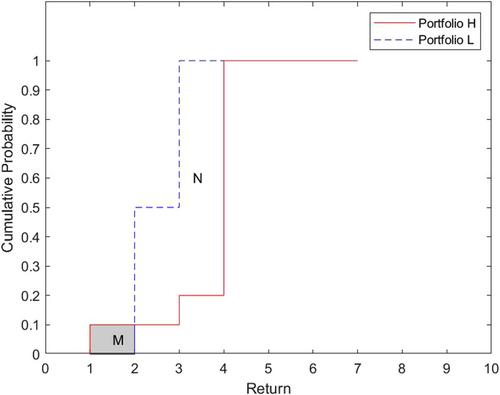

加密货币的回报率非常不正常,这让人们对标准绩效指标产生了怀疑。我们应用了几乎随机的优势,这不需要任何关于收益分布或风险规避程度的假设。从29个长短加密货币因子投资组合中,我们发现有8个在我们的四个基准中占主导地位。刘等人的三因素硬币模型无法完全解释它们的回报。因此,我们开发了一个新的三因素模型,其中动量被基于规模和风险调整动量的错误定价因子所取代,这显著提高了定价性能本文章由计算机程序翻译,如有差异,请以英文原文为准。

On the (almost) stochastic dominance of cryptocurrency factor portfolios and implications for cryptocurrency asset pricing

Cryptocurrency returns are highly nonnormal, casting doubt on the standard performance metrics. We apply almost stochastic dominance, which does not require any assumption about the return distribution or degree of risk aversion. From 29 long–short cryptocurrency factor portfolios, we find eight that dominate our four benchmarks. Their returns cannot be fully explained by the three-factor coin model of Liu et al. So we develop a new three-factor model where momentum is replaced by a mispricing factor based on size and risk-adjusted momentum, which significantly improves pricing performance.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

European Financial Management

BUSINESS, FINANCE-

CiteScore

4.30

自引率

18.20%

发文量

60

期刊介绍:

European Financial Management publishes the best research from around the world, providing a forum for both academics and practitioners concerned with the financial management of modern corporation and financial institutions. The journal publishes signficant new finance research on timely issues and highlights key trends in Europe in a clear and accessible way, with articles covering international research and practice that have direct or indirect bearing on Europe.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: