不规则时间网格下的投资组合选择:一个使用ICA-COGARCH(1,1)方法的例子。

IF 1.8

Q3 BUSINESS, FINANCE

Financial Markets and Portfolio Management

Pub Date : 2022-01-01

Epub Date: 2021-03-31

DOI:10.1007/s11408-021-00387-3

引用次数: 1

摘要

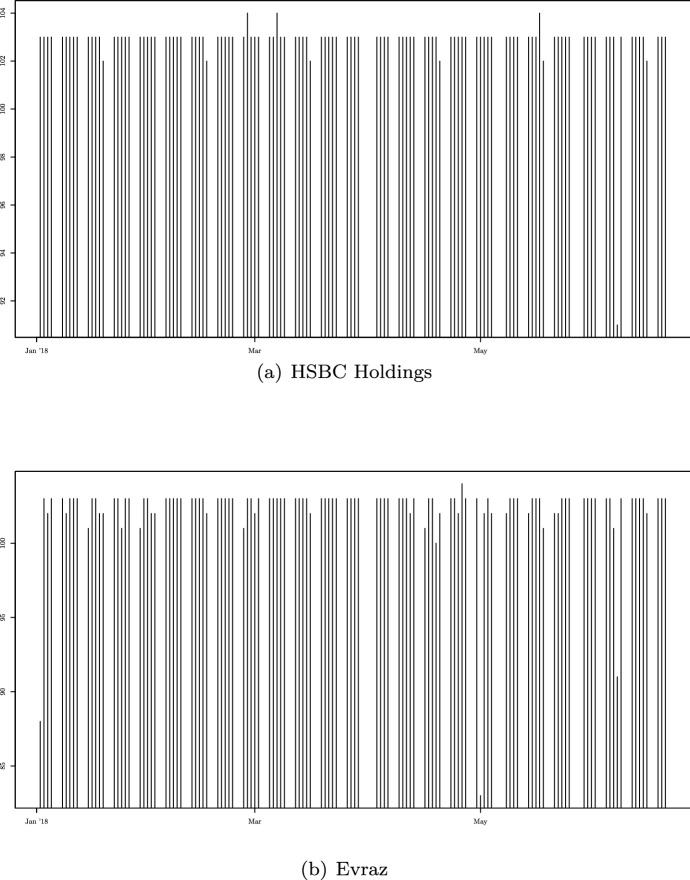

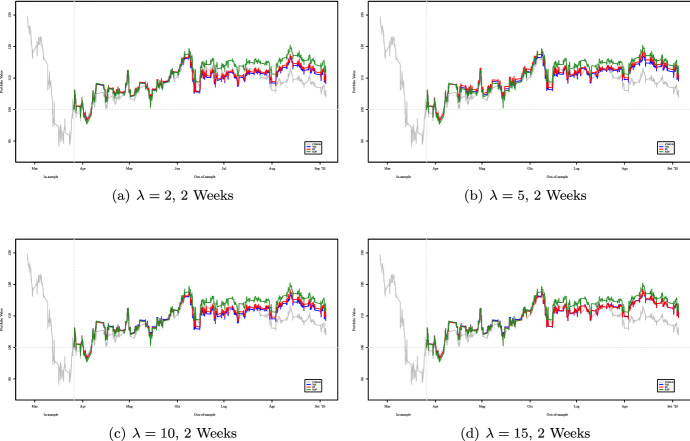

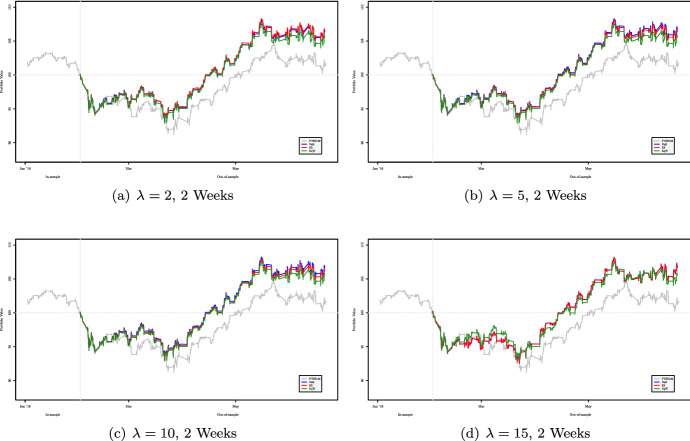

在本文中,我们考虑了一个定义为不规则间隔观测值的投资组合选择问题。我们使用独立分量分析来识别依赖结构和边际的连续时间GARCH模型。我们在不同资产的报价时间网格不同的情况下讨论市场价格的估计和模拟。我们使用两个高频数据集对所提出的方法进行了实证分析,除了频繁再平衡的严重市场条件的情况外,这些数据集提供了比竞争组合策略更好的样本外结果。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Portfolio Selection with Irregular Time Grids: an example using an ICA-COGARCH(1, 1) approach.

In this paper we consider a portfolio selection problem defined for irregularly spaced observations. We use the Independent Component Analysis for the identification of the dependence structure and continuous-time GARCH models for the marginals. We discuss both estimation and simulation of market prices in a context where the time grid of price quotations differs across assets. We present an empirical analysis of the proposed approach using two high-frequency datasets that provides better out-of-sample results than competing portfolio strategies except for the case of severe market conditions with frequent rebalancements.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Financial Markets and Portfolio Management

BUSINESS, FINANCE-

CiteScore

3.20

自引率

0.00%

发文量

21

期刊介绍:

The journal Financial Markets and Portfolio Management invites submissions of original research articles in all areas of finance, especially in – but not limited to – financial markets, portfolio choice and wealth management, asset pricing, risk management, and regulation. Its principal objective is to publish high-quality articles of innovative research and practical application. The readers of Financial Markets and Portfolio Management are academics and professionals in finance and economics, especially in the areas of asset management. FMPM publishes academic and applied research articles, shorter ''Perspectives'' and survey articles on current topics of interest to the financial community, as well as book reviews. All article submissions are subject to a double-blind peer review. http://www.fmpm.org

Officially cited as: Financ Mark Portf Manag

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: