估算环境、社会和治理评级:使用资产负债表比率的机器学习方法

IF 6.3

2区 经济学

Q1 BUSINESS, FINANCE

Research in International Business and Finance

Pub Date : 2024-11-07

DOI:10.1016/j.ribaf.2024.102653

引用次数: 0

摘要

尽管方法上的不一致性和不确定性一直存在,但 ESG 评级对于评估环境(E)、社会(S)和治理(G)风险非常有用,无论是单独还是作为一个系统(ESG)。ESG 评级类别是衡量资产类别可持续性的唯一投资选择参数。本文检验了在 t 时间观察到的一组选定的资产负债表变量和系统风险动态测量值是否具有有用的信息内容,以确定公司在 t+1 时间的 ESG 评级类别。利用 2016-2021 年期间的 EuroStoxx 600 家公司,我们采用了机器学习(ML)模型。具体来说,随机森林(RF)分类模型可以估算出 t+1 时间的 ESG 评级,其准确性在国际文献中前所未有。这一灵活简洁的模型为可持续投资者做出战略投资决策提供了重要信息,并为非上市公司和中小企业的 ESG 评级估算铺平了道路。本文章由计算机程序翻译,如有差异,请以英文原文为准。

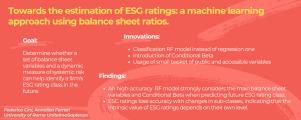

Towards the estimation of ESG ratings: A machine learning approach using balance sheet ratios

Despite the persistence of methodological inconsistency and uncertainty, ESG ratings are useful for assessing Environmental (E), Social (S), and Governance (G) risk, individually and as a system (ESG). The ESG rating class is the only investment selection parameter that measures asset class sustainability. This paper tests whether a selected set of balance sheet variables and a dynamic measure of systemic risk, observed at time t, have information content useful to identify a firm’s ESG rating class of at time t+1. Using EuroStoxx 600 firms for the period 2016–2021, we apply a Machine Learning (ML) model. Specifically, a Random Forest (RF) classification model estimates the ESG rating at time t+1 with unprecedented accuracy in the international literature. This agile and parsimonious model offers important information to the sustainable investor for making strategic investment decisions and paves the way for ESG rating estimation for unlisted companies and SMEs.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Research in International Business and Finance

BUSINESS, FINANCE-

CiteScore

11.20

自引率

9.20%

发文量

240

期刊介绍:

Research in International Business and Finance (RIBAF) seeks to consolidate its position as a premier scholarly vehicle of academic finance. The Journal publishes high quality, insightful, well-written papers that explore current and new issues in international finance. Papers that foster dialogue, innovation, and intellectual risk-taking in financial studies; as well as shed light on the interaction between finance and broader societal concerns are particularly appreciated. The Journal welcomes submissions that seek to expand the boundaries of academic finance and otherwise challenge the discipline. Papers studying finance using a variety of methodologies; as well as interdisciplinary studies will be considered for publication. Papers that examine topical issues using extensive international data sets are welcome. Single-country studies can also be considered for publication provided that they develop novel methodological and theoretical approaches or fall within the Journal''s priority themes. It is especially important that single-country studies communicate to the reader why the particular chosen country is especially relevant to the issue being investigated. [...] The scope of topics that are most interesting to RIBAF readers include the following: -Financial markets and institutions -Financial practices and sustainability -The impact of national culture on finance -The impact of formal and informal institutions on finance -Privatizations, public financing, and nonprofit issues in finance -Interdisciplinary financial studies -Finance and international development -International financial crises and regulation -Financialization studies -International financial integration and architecture -Behavioral aspects in finance -Consumer finance -Methodologies and conceptualization issues related to finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: