为什么管理者要宣布出售大型资产的意图?

IF 2.6

4区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

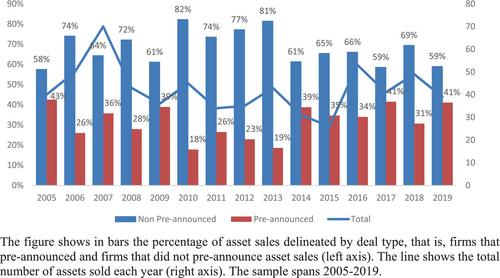

近三分之一的资产出售公告在发布之前都会公开声明出售意向。这些自愿披露产生了 1.1% 的可观平均回报。预公告使实际资产出售前后的回报率趋于零。由于管理者的机会主义行为,预公告发生在股票表现不佳和首席执行官更替之后。管理者也会在预公告前后择机行使期权,并从股价上涨中获得潜在收益。虽然我们没有发现预披露对长期经营业绩的影响,但使用三因子和四因子模型,我们确实观察到预披露对股票回报率的负面影响。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Why do managers announce the intention to sell large assets?

Nearly one-third of asset sale announcements are preceded by a public statement of the intent to sell. These voluntary disclosures generate significant average returns of 1.1%. Pre-announcements bias returns around the actual asset sales toward zero. Due to opportunistic managerial behavior, pre-announcements occur after poor stock performance and CEO turnover. Managers also opportunistically exercise options around the pre-announcements and receive potential benefits from the uptick in stock prices. Although we find no effect of pre-announcements on long-term operational performance, we do observe a negative effect on stock returns using three and four-factor models.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

International Review of Finance

BUSINESS, FINANCE-

CiteScore

3.30

自引率

5.90%

发文量

28

期刊介绍:

The International Review of Finance (IRF) publishes high-quality research on all aspects of financial economics, including traditional areas such as asset pricing, corporate finance, market microstructure, financial intermediation and regulation, financial econometrics, financial engineering and risk management, as well as new areas such as markets and institutions of emerging market economies, especially those in the Asia-Pacific region. In addition, the Letters Section in IRF is a premium outlet of letter-length research in all fields of finance. The length of the articles in the Letters Section is limited to a maximum of eight journal pages.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: