美式期权提前行使溢价的实证研究:来自 OEX 和 XEO 期权的证据

IF 1.8

4区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

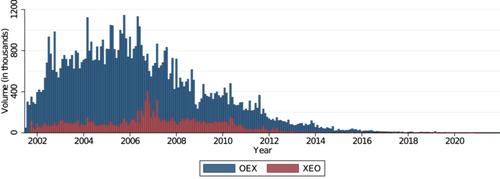

由于 S&P 100 指数是美式期权(OEX)和欧式期权(XEO)的基础,因此可以直接观察到美式期权提前行权溢价的价值。我们发现 XEO 期权的中间报价可能高于其他相同的 OEX 期权,而流动性可以解释欧式期权的这种定价过高现象。我们的结果表明,在 S&P 100 指数期权市场上,流动性差的期权定价明显偏高。这一结果表明,非流动性期权可以通过较高的市场要约价格被高估,而市场要约价格是做市商提供流动性的补偿要求。本文章由计算机程序翻译,如有差异,请以英文原文为准。

An empirical study on the early exercise premium of American options: Evidence from OEX and XEO options

Since the S&P 100 Index underlies both American (OEX) and European (XEO) options, the value of the early exercise premium of American options can be directly observed. We find that the mid-quote of an XEO option can be higher than that of an otherwise identical OEX option, and liquidity can explain this overpricing phenomenon of European options. Our results show that illiquid options are significantly overpriced in the S&P 100 Index options market. This finding indicates that an illiquid option can be overvalued with a higher market offer price, which is the requirement of market makers for compensation for providing liquidity.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Futures Markets

BUSINESS, FINANCE-

CiteScore

3.70

自引率

15.80%

发文量

91

期刊介绍:

The Journal of Futures Markets chronicles the latest developments in financial futures and derivatives. It publishes timely, innovative articles written by leading finance academics and professionals. Coverage ranges from the highly practical to theoretical topics that include futures, derivatives, risk management and control, financial engineering, new financial instruments, hedging strategies, analysis of trading systems, legal, accounting, and regulatory issues, and portfolio optimization. This publication contains the very latest research from the top experts.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: