从价税的法定发生率问题

IF 1.7

4区 经济学

Q2 ECONOMICS

引用次数: 0

摘要

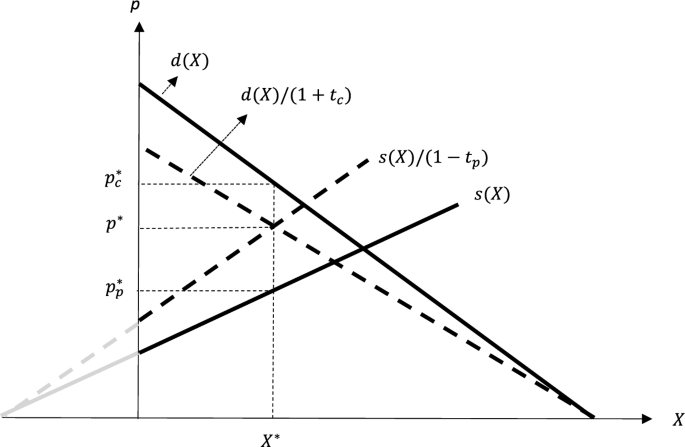

众所周知,对某一特定税种而言,其经济发生率并不取决于市场的哪一方负有纳税的法律义务。在本文中,我们将证明,对于从价税而言,这种法律发生率确实与经济发生率有关。具体而言,当政府对商品销售征收从价税时,当卖方有义务缴税时,市场均衡销售水平的下降幅度会大于买方有义务缴税时的下降幅度。本文章由计算机程序翻译,如有差异,请以英文原文为准。

The legal incidence of ad valorem taxes matters

It is well known that, for a specific tax, its economic incidence does not depend on which side of the market has the legal obligation to pay the tax. In this paper, we show that, for an ad valorem tax, this legal incidence does matter for the economic incidence. In particular, when a government imposes an ad valorem tax rate on the sale of a commodity, the resulting reduction in the market equilibrium level of sales will be larger when sellers are obliged to pay the tax than when buyers are obliged to pay the tax.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Economics

ECONOMICS-

CiteScore

1.70

自引率

11.80%

发文量

38

期刊介绍:

Specializing in mathematical economic theory, Journal of Economics focuses on microeconomic theory while also publishing papers on macroeconomic topics as well as econometric case studies of general interest. Regular supplementary volumes are devoted to topics of central importance to both modern theoretical research and present economic reality. Fields of interest: applied economic theory and ist empirical testing.Officially cited as: J Econ

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: