违约风险沿供应链垂直传播

IF 1.9

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

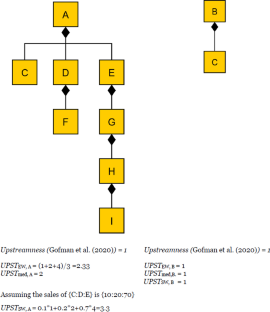

本研究调查了违约风险在供应链上的传播。我们采用 Gofman 等人(Rev Financ Stud 33:5856-5905, 2020 年)提出的企业特定上游度量方法的改进版,来评估每个企业与供应链中最终消费产品的垂直距离。我们发现,上游企业面临的违约风险更大,而上游效应对于那些属于不那么突出、杠杆率更高和多样性更低的供应链的企业来说更为显著。我们还发现,陷入困境的企业只会影响其上游供应商,而不会影响其下游客户。我们的结果在不同的经验规格下都是稳健的。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Vertical propagation of default risk along the supply chain

This study investigates the propagation of default risk along the supply chain. We adopt a modified version of the firm-specific upstreamness measure from Gofman et al. (Rev Financ Stud 33:5856–5905, 2020) to assess each firm's vertical distance to the final consumption products in the supply chain. We find that upstream firms are more exposed to default risk, and the upstream effect is more substantial for firms that belong to less prominent, more leveraged, and less diverse supply chains. We also find that a distressed firm only affects its upstream suppliers but not its downstream customers. Our results are robust across various empirical specifications.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Quantitative Finance and Accounting

BUSINESS, FINANCE-

CiteScore

3.20

自引率

17.60%

发文量

87

期刊介绍:

Review of Quantitative Finance and Accounting deals with research involving the interaction of finance with accounting, economics, and quantitative methods, focused on finance and accounting. The papers published present useful theoretical and methodological results with the support of interesting empirical applications. Purely theoretical and methodological research with the potential for important applications is also published. Besides the traditional high-quality theoretical and empirical research in finance, the journal also publishes papers dealing with interdisciplinary topics.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: