具有(非)线性价格影响的相对投资者的纳什均衡

IF 1

3区 经济学

Q3 BUSINESS, FINANCE

引用次数: 0

摘要

我们考虑的是 n 个投资者的战略互动,他们能够影响股票价格进程,同时衡量自己相对于其他投资者的效用。我们的主要目的是在由布朗运动驱动的金融市场中找到纳什均衡投资策略,并研究价格影响对均衡的影响。我们同时考虑了 CRRA 和 CARA 效用函数。我们的研究结果表明,只要价格影响至多是线性的,问题就能得到很好的解决。此外,数值结果显示,当价格影响接近临界参数时,投资者的行为非常激进。本文章由计算机程序翻译,如有差异,请以英文原文为准。

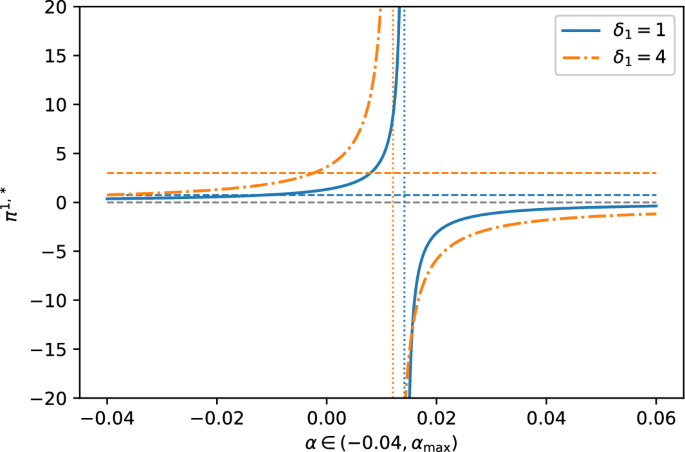

Nash equilibria for relative investors with (non)linear price impact

We consider the strategic interaction of n investors who are able to influence a stock price process and at the same time measure their utilities relative to the other investors. Our main aim is to find Nash equilibrium investment strategies in this setting in a financial market driven by a Brownian motion and investigate the influence the price impact has on the equilibrium. We consider both CRRA and CARA utility functions. Our findings show that the problem is well-posed as long as the price impact is at most linear. Moreover, numerical results reveal that the investors behave very aggressively when the price impact is close to a critical parameter.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Mathematics and Financial Economics

MATHEMATICS, INTERDISCIPLINARY APPLICATIONS -

CiteScore

2.80

自引率

6.20%

发文量

17

期刊介绍:

The primary objective of the journal is to provide a forum for work in finance which expresses economic ideas using formal mathematical reasoning. The work should have real economic content and the mathematical reasoning should be new and correct.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: