动态非终端破产模型中注入资本的最优股息决策

IF 1.9

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

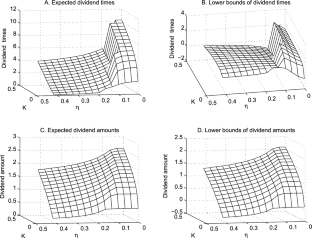

我们建立了一个股息优化的随机动态模型,其条件是正向复苏(股东可收回部分资本)以及私人资本注入或政府救助导致的非终局破产。在出现复苏的情况下,优化问题变成了混合经典脉冲随机控制问题。我们为非终局破产下的最优股利支付和时间选择提供了闭式解。我们将该模型应用到实际数据中,结果表明该模型可以解释金融危机期间美国政府救助保险公司和银行时的股息之谜。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Optimal dividend decisions with capital infusion in a dynamic nonterminal bankruptcy model

We develop a stochastic dynamic model of dividend optimization under the conditions of a positive recovery, in which shareholders can recover a portion of their capital, and nonterminal bankruptcy due to private capital infusion or government bailout. In the presence of a recovery, the optimization problem becomes a mixed classical impulse stochastic control problem. We provide a closed-form solution for optimal dividend payout and timing under nonterminal bankruptcy. We take the model to the real data and show that this model explains the dividend puzzle during the financial crisis when the US government bailed out insurance companies and banks.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Quantitative Finance and Accounting

BUSINESS, FINANCE-

CiteScore

3.20

自引率

17.60%

发文量

87

期刊介绍:

Review of Quantitative Finance and Accounting deals with research involving the interaction of finance with accounting, economics, and quantitative methods, focused on finance and accounting. The papers published present useful theoretical and methodological results with the support of interesting empirical applications. Purely theoretical and methodological research with the potential for important applications is also published. Besides the traditional high-quality theoretical and empirical research in finance, the journal also publishes papers dealing with interdisciplinary topics.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: