市场力量和系统性风险

IF 6

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

我们研究了产品市场竞争对企业系统性风险的影响。通过衡量产品市场的总体相似性,我们发现市场力量与市场押注之间存在很强的负相关关系。在最近的低竞争时期,这种影响增加了两倍多。反竞争兼并导致市场押注显著下降。面临较少竞争的企业似乎可以部分抵御系统性贴现率冲击。因此,较低的股本成本意味着市场力量在一定程度上可以自我延续。本文章由计算机程序翻译,如有差异,请以英文原文为准。

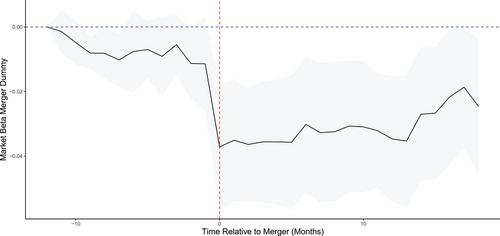

Market power and systematic risk

We examine the impact of product market competition on firms' systematic risk. Using a measure of total product market similarity, we document a strong negative relationship between market power and market betas. The effect more than triples in the most recent period of low competition. Anticompetitive mergers result in a significant reduction in market betas. Firms facing less competition seem to be partially insulated from systematic discount-rate shocks. Lower equity costs therefore imply that market power is partly self-perpetuating.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Financial Management

BUSINESS, FINANCE-

CiteScore

6.00

自引率

0.00%

发文量

27

期刊介绍:

Financial Management (FM) serves both academics and practitioners concerned with the financial management of nonfinancial businesses, financial institutions, and public or private not-for-profit organizations.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: