欧盟向低碳经济有序转型的融资:银行渠道的监管框架

IF 1.5

Q3 BUSINESS, FINANCE

引用次数: 0

摘要

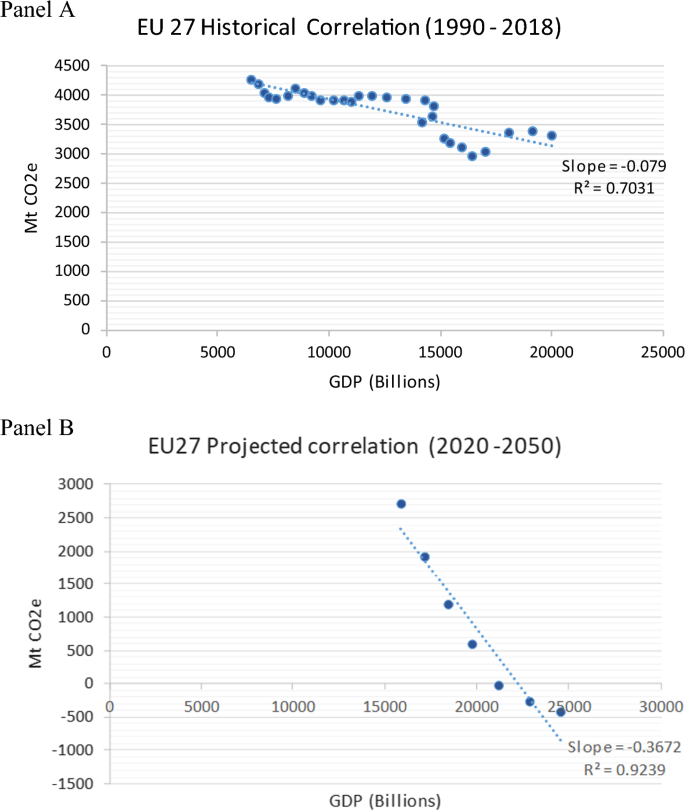

在世界上最大的经济体中,欧盟不仅为减少温室气体排放设定了最雄心勃勃、最具法律约束力的目标,而且在投资者保护、安全和稳健方面,欧盟还制定了“最先进”的监管框架。本文以银行融资渠道为重点,强调了需要改进的监管领域。为了在全球范围内调动必要的资金,需要在一定程度上实现区域分类法的互操作性,这就需要国际间的交叉授粉和协调,以减轻金融风险和有害的市场碎片化风险(BCBS 2022, FSB 2022)。此外,国际和欧盟公司报告标准之间的完全互操作性是一个理想的目标。构建集团方法将使这种互操作性变得更容易,因为“双重重要性目标”的可持续性影响视角是欧盟企业的所有投资者都能很好地理解的国际要求的额外一层。根据审慎监管中包含的气候风险,它完成了与欧盟分类有效相关的第三支柱披露。气候风险的长期前景仍然需要在支柱2中实施,将银行转型计划与基于气候风险情景分析的压力测试联系起来,包括转型风险和物理风险。将气候风险纳入第一支柱面临着与国际监管机构类似的挑战。培养全球雄心是欧盟的一个明确目标。它在投资者保护和气候风险审慎监管领域的领导地位,应该为国际合作和国际标准提供理想的指导。这将确保实现欧盟气候目标的投资将来自欧盟内外。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Financing the orderly transition to a low carbon economy in the EU: the regulatory framework for the banking channel

Abstract Among the largest economies of the world, the EU not only has set the most ambitious and legally binding objectives for the reduction of the GHG emissions but also it has accompanied these objectives with a “state of the art” regulatory framework in the realms of investor protection and safety and soundness. Our paper focuses on the bank financing channel and highlights regulatory areas for improvement. To mobilize the necessary funds worldwide, a degree of interoperability of regional taxonomies is required, which calls for international cross-pollination and coordination to mitigate financial risks and the risk of harmful market fragmentation (BCBS 2022, FSB 2022). Also, the full interoperability between the international and the EU corporate reporting standards is a desirable objective. A building bloc methodological approach would make such interoperability easier having the sustainability impact perspective of the “double materiality objective” as an additional layer of the international requirements well understood to all investors in EU undertakings. As per the inclusion of climate risks in prudential regulation, it is completed for Pillar 3 disclosures relating effectively with the EU Taxonomy. Climate risk’s long-term horizon still needs to be implemented in Pillar 2 by linking bank transition plans with stress testing based on climate risk scenario analysis covering both transition and physical risk. The inclusion of climate risks in Pillar 1 faces challenges similar to those of supervisors internationally. Fostering global ambition is an explicit objective of the EU. Its leadership on the realms of investor protection and prudential regulation of climate risks should ideally inform international cooperation and impregnate international standards. This will secure that investments for the fulfillment of the EU climate objectives will flow from in and outside the EU.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

CiteScore

3.70

自引率

6.20%

发文量

21

期刊介绍:

Under the guidance of its highly respected Editors and an eminent and truly international Editorial Board?Journal of Banking Regulation?has established itself as one of the leading sources of authoritative and detailed information on all aspects of law and regulation affecting banking institutions.Journal of Banking Regulation?publishes in each quarterly issue detailed briefings analyses and updates which are of direct relevance to practitioners working in the field while meeting the highest intellectual standards.Journal of Banking Regulation?publishes the latest thinking and best practice on:Basel I II and IIIModels for banking supervisionInternational accounting standardsDeposit protectionEnforcement decisions in banking regulation and supervisionCross-border competition in banking servicesCorporate governance in banksHarmonisation in banking marketsSupervising credit riskAnti-money laundering legislation and regulationsMonetary integrationRisk capital and capital adequacySystemic risk in banking operationsCross-border regulationCross-border bank insolvencyModels for banking riskEssential reading for:central bankersbanking supervisorsfinancial regulatorsbankerscompliance officersheads of risk managementpolicy makersbank associationslawyers specialising in banking lawaccountantsinternal and external bank auditorsacademics and researchers

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: