经济政策不确定性、地缘政治风险、市场情绪和地区股票:欧盟行业的不对称分析

IF 2.5

Q2 ECONOMICS

引用次数: 3

摘要

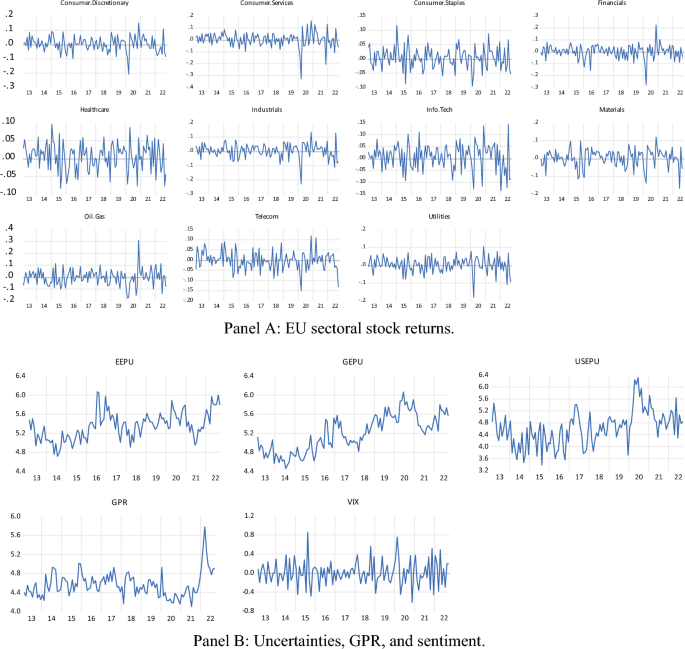

摘要本研究旨在探讨经济政策不确定性(EPU)、地缘政治风险(GPR)和市场情绪(VIX)对欧盟(EU)股票的不对称影响。我们研究的设计和方法方法是基于参数和非参数分位数的技术。除了GPR、全球EPU、欧盟EPU、美国EPU和VIX之外,我们还采用了涵盖11个经济活动部门的月度数据。我们的数据集涵盖了2013年2月至2022年9月期间。我们的研究结果表明,考虑EPU措施对欧盟部门股票回报的预测能力普遍较低。尽管如此,分析显示欧盟EPU对欧盟行业股票收益的预测能力最高,而美国EPU对欧盟行业股票收益的预测能力不显著。我们的研究结果还强调了各种epu对欧盟股票的不对称影响。此外,某些行业对欧盟股票的敞口在正常市场条件下可以起到分散风险的作用,但在极端经济条件下可能成为对冲GPR的避险工具。我们的研究结果还强调了VIX作为对冲欧盟股市下行风险的良好指标的作用。我们工作的独创性是双重的。首先,我们将全球因素如何影响欧盟股票市场的研究扩展到最近的时期,包括俄罗斯-乌克兰冲突。其次,我们在部门基础上进行这项研究。因此,我们的研究结果的价值在于,它们为市场监管和投资组合管理提供了显著的启示。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Economic policy uncertainty, geopolitical risk, market sentiment, and regional stocks: asymmetric analyses of the EU sectors

Abstract The purpose of this study is to investigate the asymmetric effects of economic policy uncertainty (EPU), geopolitical risk (GPR), and market sentiment (VIX) on European Union (EU) stocks by sectors of economic activity. The design and methodological approach of our research are rooted in parametric and nonparametric quantile-based techniques. We employ monthly data covering eleven sectors of economic activity in addition to GPR, Global EPU, European Union EPU, United States EPU, and VIX. Our dataset covers the period between February 2013 and September 2022. Our findings show a generally low predictive power of the considered EPU measures on the stock returns of the EU sectors. Notwithstanding, the analysis reveals that EPU from the EU has the highest predictive ability on the EU sectoral stock returns while EPU from the US has no significant predictive ability on the stock returns from the EU. Our findings also highlight the asymmetric effects of various EPUs on EU stocks. Moreover, certain sectoral exposure to EU stocks, found to serve just as diversifiers in normal market conditions, could become a hedge and safe-haven against GPR in extreme economic conditions. Our findings also highlight the role of the VIX as a good gauge to hedge against the downside risks of the EU stocks. The originality of our work is two-fold. First, we extend the study of how global factors influence the EU stock market to the most recent period including the Russia–Ukraine conflict. Second, we perform this study on a sectoral basis. Therefore, the value of our findings is that they provide notable implications for market regulation and portfolio management.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Eurasian Economic Review

ECONOMICS-

CiteScore

6.00

自引率

2.90%

发文量

24

期刊介绍:

The mission of Eurasian Economic Review is to publish peer-reviewed empirical research papers that test, extend, or build theory and contribute to practice. All empirical methods - including, but not limited to, qualitative, quantitative, field, laboratory, and any combination of methods - are welcome. Empirical, theoretical and methodological articles from all fields of finance and applied macroeconomics are featured in the journal. Theoretical and/or review articles that integrate existing bodies of research and that provide new insights into the field are highly encouraged. The journal has a broad scope, addressing such issues as: financial systems and regulation, corporate and start-up finance, macro and sustainable finance, finance and innovation, consumer finance, public policies on financial markets within local, regional, national and international contexts, money and banking, and the interface of labor and financial economics. The macroeconomics coverage includes topics from monetary economics, labor economics, international economics and development economics.

Eurasian Economic Review is published quarterly. To be published in Eurasian Economic Review, a manuscript must make strong empirical and/or theoretical contributions and highlight the significance of those contributions to our field. Consequently, preference is given to submissions that test, extend, or build strong theoretical frameworks while empirically examining issues with high importance for theory and practice. Eurasian Economic Review is not tied to any national context. Although it focuses on Europe and Asia, all papers from related fields on any region or country are highly encouraged. Single country studies, cross-country or regional studies can be submitted.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: