气候风险之间的依赖关系对非寿险公司资产和责任方面的影响

IF 1.6

Q4 BUSINESS, FINANCE

引用次数: 0

摘要

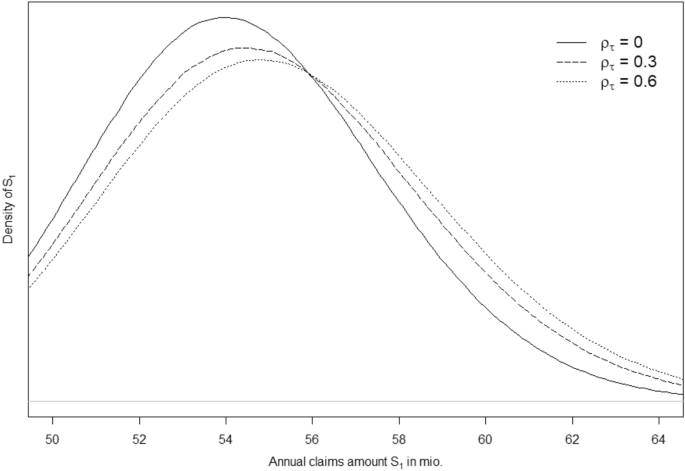

摘要本文的目的是研究气候变化和物理风险之间的依赖关系对非寿险保险公司违约概率和盈利能力的影响,重点关注延迟和突然转变的情景。为此,我们提出了一种简化的建模方法,用于影响资产和负债的气候风险情景分析,考虑到潜在的非线性依赖结构。我们的研究结果表明,在物理转换情景下,对负债侧和资产与负债之间的依赖关系会产生重大影响,特别是对非寿险保险公司的违约风险。我们还分析了止损再保险和风险调整定价的缓解效果,如果实施,这似乎是一种有效的风险管理措施,特别是针对物理气候风险。本文章由计算机程序翻译,如有差异,请以英文原文为准。

The impact of dependencies between climate risks on the asset and liability side of non-life insurers

Abstract The aim of this paper is to examine the impact of dependencies between climate transition and physical risks on the default probability and profitability of a non-life insurer focusing on the scenario of a delayed and sudden transition. Toward this end, we suggest a simplified modeling approach for scenario analyses for climate risks affecting assets and liabilities, taking into account potential nonlinear dependence structures. Our results show that dependencies on the liability side and between assets and liabilities in the context of physical-transition scenarios can have a significant impact, particularly on the default risk of a non-life insurer. We additionally analyze the mitigating effects of stop loss reinsurance and risk-adjusted pricing, which—if implementable—seem to be an effective risk management measure against physical climate risks in particular.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

European Actuarial Journal

BUSINESS, FINANCE-

CiteScore

2.30

自引率

8.30%

发文量

35

期刊介绍:

Actuarial science and actuarial finance deal with the study, modeling and managing of insurance and related financial risks for which stochastic models and statistical methods are available. Topics include classical actuarial mathematics such as life and non-life insurance, pension funds, reinsurance, and also more recent areas of interest such as risk management, asset-and-liability management, solvency, catastrophe modeling, systematic changes in risk parameters, longevity, etc. EAJ is designed for the promotion and development of actuarial science and actuarial finance. For this, we publish original actuarial research papers, either theoretical or applied, with innovative applications, as well as case studies on the evaluation and implementation of new mathematical methods in insurance and actuarial finance. We also welcome survey papers on topics of recent interest in the field. EAJ is the successor of six national actuarial journals, and particularly focuses on links between actuarial theory and practice. In order to serve as a platform for this exchange, we also welcome discussions (typically from practitioners, with a length of 1-3 pages) on published papers that highlight the application aspects of the discussed paper. Such discussions can also suggest modifications of the studied problem which are of particular interest to actuarial practice. Thus, they can serve as motivation for further studies.Finally, EAJ now also publishes ‘Letters’, which are short papers (up to 5 pages) that have academic and/or practical relevance and consist of e.g. an interesting idea, insight, clarification or observation of a cross-connection that deserves publication, but is shorter than a usual research article. A detailed description or proposition of a new relevant research question, short but curious mathematical results that deserve the attention of the actuarial community as well as novel applications of mathematical and actuarial concepts are equally welcome. Letter submissions will be reviewed within 6 weeks, so that they provide an opportunity to get good and pertinent ideas published quickly, while the same refereeing standards as for other submissions apply. Both academics and practitioners are encouraged to contribute to this new format. Authors are invited to submit their papers online via http://euaj.edmgr.com.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: