交易所交易基金是否会影响企业现金持有量?

IF 2.2

3区 管理学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

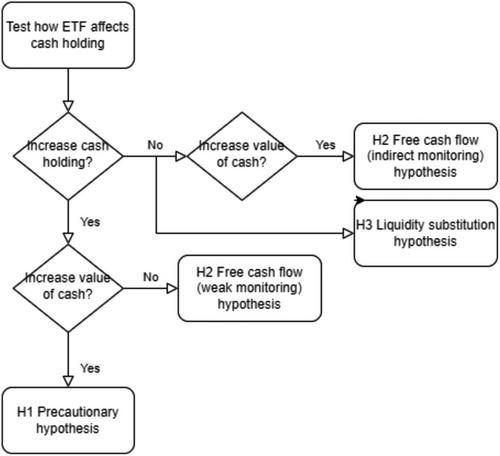

我们研究了交易所交易基金(ETF)持有股票对企业现金持有量的影响。我们发现,企业会增加现金持有量,以应对 ETF 带来的更高预期风险。为了建立因果解释,我们使用罗素 1000/2000 指数重组作为 ETF 所有权的工具。我们进一步表明,股东更看重 ETF 持有量较高的公司所持有的额外现金。这些发现在财务紧张的公司中更为明显。总体而言,我们的研究结果表明,由于 ETF 引发的风险较高,企业持有更多预防性现金以缓解未来的资金需求。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Do exchange traded funds affect corporate cash holdings?

We examine the effects of equity ownership by exchange traded funds (ETFs) on corporate cash holdings. We find that firms increase their cash holdings in response to higher anticipated risks generated by ETFs. To establish a causal interpretation, we use the Russell 1000/2000 index reconstitution as an instrument for ETF ownership. We further show that shareholders place a higher value on the additional cash held by firms with higher ETF ownership. These findings are more pronounced among financially constrained firms. Overall, our results suggest that firms hold more precautionary cash to mitigate future funding needs due to higher ETF-induced risks.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Business Finance & Accounting

BUSINESS, FINANCE-

CiteScore

4.40

自引率

17.20%

发文量

70

期刊介绍:

Journal of Business Finance and Accounting exists to publish high quality research papers in accounting, corporate finance, corporate governance and their interfaces. The interfaces are relevant in many areas such as financial reporting and communication, valuation, financial performance measurement and managerial reward and control structures. A feature of JBFA is that it recognises that informational problems are pervasive in financial markets and business organisations, and that accounting plays an important role in resolving such problems. JBFA welcomes both theoretical and empirical contributions. Nonetheless, theoretical papers should yield novel testable implications, and empirical papers should be theoretically well-motivated. The Editors view accounting and finance as being closely related to economics and, as a consequence, papers submitted will often have theoretical motivations that are grounded in economics. JBFA, however, also seeks papers that complement economics-based theorising with theoretical developments originating in other social science disciplines or traditions. While many papers in JBFA use econometric or related empirical methods, the Editors also welcome contributions that use other empirical research methods. Although the scope of JBFA is broad, it is not a suitable outlet for highly abstract mathematical papers, or empirical papers with inadequate theoretical motivation. Also, papers that study asset pricing, or the operations of financial markets, should have direct implications for one or more of preparers, regulators, users of financial statements, and corporate financial decision makers, or at least should have implications for the development of future research relevant to such users.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: