直到税收把我们分开?婚姻税对结婚率的影响

IF 1.4

4区 经济学

Q3 ECONOMICS

引用次数: 0

摘要

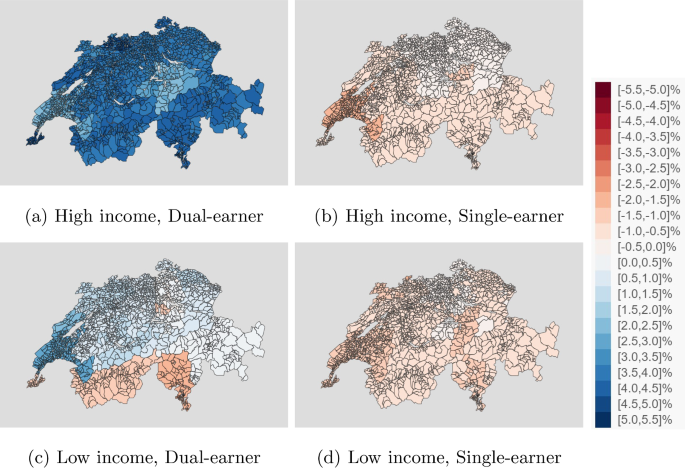

已婚夫妇作为一个单位纳税时,其税负可能比收入相同的同居夫妇更高或更低。我研究了这种共同所得税对瑞士结婚率的影响,在瑞士,已婚和同居夫妇之间的税收差异在各州之间差别很大。为此,我构建了一个包含每个居住在瑞士的个人的社会人口和经济变量的数据集,并使用家庭层面的信息来识别同居伴侣。使用模拟工具变量方法,我发现共同所得税对2012年至2019年结婚的夫妇的结婚率产生了负面影响。这种影响是由没有孩子的家庭和收入分配的低端造成的。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Till taxes keep us apart? The impact of the marriage tax on the marriage rate

Abstract Married couples can face a higher or lower tax burden than cohabitating couples with the same income when the former are taxed as one unit. I study the effect of such joint income taxation on the marriage rate in Switzerland, where tax differentials between married and cohabitating couples vary considerably across cantons. For this purpose, I construct a dataset containing sociodemographic and -economic variables on every individual living in Switzerland and use household-level information to identify cohabitating couples. Using a simulated instrumental variable approach, I find a negative impact of joint income taxation on the marriage rate for couples married between 2012 and 2019. The effect is driven by households without children and from the lower end of the income distribution.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

International Tax and Public Finance

ECONOMICS-

CiteScore

2.40

自引率

10.00%

发文量

56

期刊介绍:

INTERNATIONAL TAX AND PUBLIC FINANCE publishes outstanding original research, both theoretical and empirical, in all areas of public economics. While the journal has a historical strength in open economy, international, and interjurisdictional issues, we actively encourage high-quality submissions from the breadth of public economics.The special Policy Watch section is designed to facilitate communication between the academic and public policy spheres. This section includes timely, policy-oriented discussions. The goal is to provide a two-way forum in which academic researchers gain insight into current policy priorities and policy-makers can access academic advances in a practical way. INTERNATIONAL TAX AND PUBLIC FINANCE is peer reviewed and published in one volume per year, consisting of six issues, one of which contains papers presented at the annual congress of the International Institute of Public Finance (refereed in the usual way). Officially cited as: Int Tax Public Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: