分析师能力和研究努力:非eps预测提供作为研究质量的信号

IF 5.8

3区 管理学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

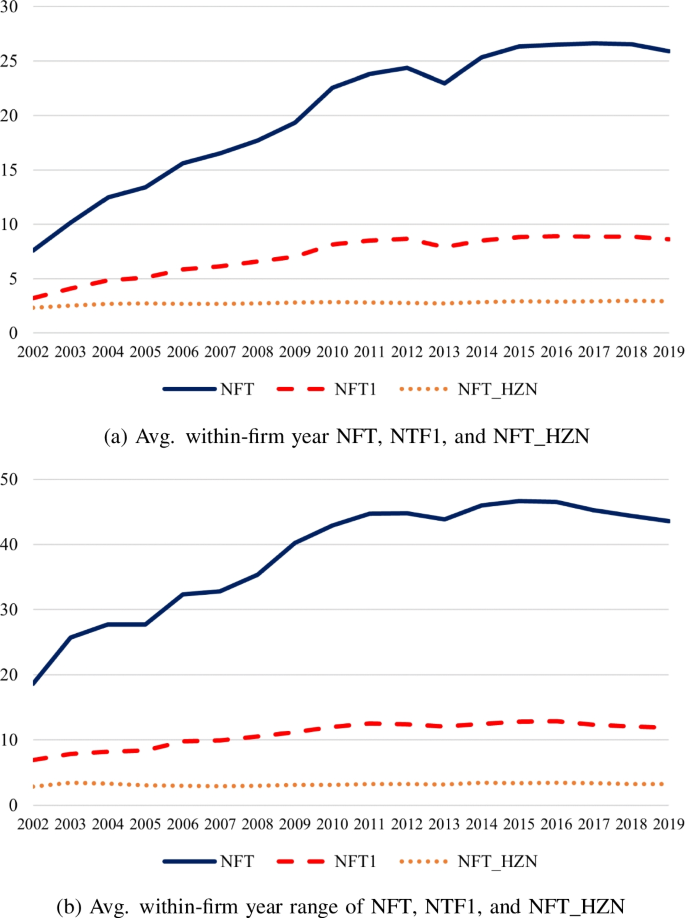

个别分析师提供的非每股收益预测类型的范围随着时间的推移而急剧增加,但在不同的公司之间差异很大。我们建议,在提供更广泛的预测类型时,分析师可以显示出卓越的研究能力和研究努力。根据这一假设,我们记录了分析师提供的预测类型(NFT)数量与研究质量的常见代理之间的正相关关系,包括盈利预测准确性、目标价格准确性、股票推荐盈利能力、市场对股票推荐修订的反应以及分析师的职业成果。NFT对文献中使用的其他质量代理的影响是递增的,并且与先前研究的特定非每股收益预测类型(例如,现金流量预测)的发布不同。我们通过检验以NFT为条件形成的投资组合的样本外表现,并利用共识收益预测和个别分析师股票建议的修正,向投资者展示了NFT的信息价值。我们得出的结论是,分析师为公司提供的预测类型的数量是其研究质量的现成代理。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Analyst ability and research effort: non-EPS forecast provision as a research quality signal

Abstract The range of non-EPS forecast types provided by individual analysts to I/B/E/S has increased dramatically over time but varies considerably across firms. We propose that in providing a broader range of forecast types, analysts can signal superior research ability and research effort. Consistent with this hypothesis, we document positive associations between the number of forecast types (NFT) an analyst provides and common proxies for research quality, including earnings forecast accuracy, price target accuracy, stock recommendation profitability, market reactions to stock recommendation revisions, and analyst career outcomes. The effects of NFT are incremental to other quality proxies used in the literature and are distinct from the issuance of specific non-EPS forecast types studied previously (e.g., cash flow forecasts). We demonstrate the information value of NFT to investors by examining the out-of-sample performance of portfolios formed conditional on NFT and exploiting revisions in consensus earnings forecasts and individual analysts’ stock recommendations. We conclude that the number of forecast types an analyst provides for a firm is a readily available proxy for the quality of her research.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Accounting Studies

BUSINESS, FINANCE-

CiteScore

7.90

自引率

7.10%

发文量

82

期刊介绍:

Review of Accounting Studies provides an outlet for significant academic research in accounting including theoretical, empirical, and experimental work. The journal is committed to the principle that distinctive scholarship is rigorous. While the editors encourage all forms of research, it must contribute to the discipline of accounting. The Review of Accounting Studies is committed to prompt turnaround on the manuscripts it receives. For the majority of manuscripts the journal will make an accept-reject decision on the first round. Authors will be provided the opportunity to revise accepted manuscripts in response to reviewer and editor comments; however, discretion over such manuscripts resides principally with the authors. An editorial revise and resubmit decision is reserved for new submissions which are not acceptable in their current version, but for which the editor sees a clear path of changes which would make the manuscript publishable. Officially cited as: Rev Account Stud

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: