可预测的每股收益增长和价值投资的表现

IF 5.8

3区 管理学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

摘要以往的研究发现,每股收益增长率难以预测,其原因是大部分观察到的估值比率的横截面变化是由于隐含的未来股票收益的变化。然而,观察到的估值比率与实现的未来股票回报之间的横截面关系很弱。我们使用一种精确的预期每股收益增长率测量方法来重新审视这些发现,并记录了每股收益增长率可预测性的有力证据。此外,我们发现这种可预测的增长将持续两年以上,并在观察到的估值比率中得到强烈反映。我们表明,将估值比率与我们对预期每股收益增长率的精确衡量相结合,可以改善对股票回报的预测,尽管回报的可预测性仍然很弱。因此,我们得出结论,估值比率的大部分变化是由可预测的每股收益增长驱动的。本文章由计算机程序翻译,如有差异,请以英文原文为准。

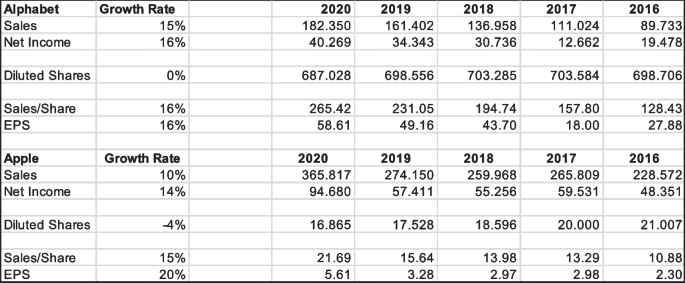

Predictable EPS growth and the performance of value investing

Abstract Previous research finds that EPS growth rates are difficult to predict and reasons that much of the observed cross-sectional variation in valuation ratios is due to variation in implied future stock returns. Yet the observed cross-sectional relation between valuation ratios and realized future stock returns is weak. We revisit these findings using a refined measure of expected EPS growth rates and document robust evidence of predictability in EPS growth rates. Moreover, we find that this predictable growth extends beyond two years into the future and is strongly reflected in observed valuation ratios. We show that combining valuation ratios with our refined measure of expected EPS growth rates improves forecasts of stock returns, though return predictability remains weak. Thus, we conclude that most of the variation in valuation ratios is driven by predictable EPS growth.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Accounting Studies

BUSINESS, FINANCE-

CiteScore

7.90

自引率

7.10%

发文量

82

期刊介绍:

Review of Accounting Studies provides an outlet for significant academic research in accounting including theoretical, empirical, and experimental work. The journal is committed to the principle that distinctive scholarship is rigorous. While the editors encourage all forms of research, it must contribute to the discipline of accounting. The Review of Accounting Studies is committed to prompt turnaround on the manuscripts it receives. For the majority of manuscripts the journal will make an accept-reject decision on the first round. Authors will be provided the opportunity to revise accepted manuscripts in response to reviewer and editor comments; however, discretion over such manuscripts resides principally with the authors. An editorial revise and resubmit decision is reserved for new submissions which are not acceptable in their current version, but for which the editor sees a clear path of changes which would make the manuscript publishable. Officially cited as: Rev Account Stud

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: