全球最低税的经济学

IF 1.4

4区 经济学

Q3 ECONOMICS

引用次数: 0

摘要

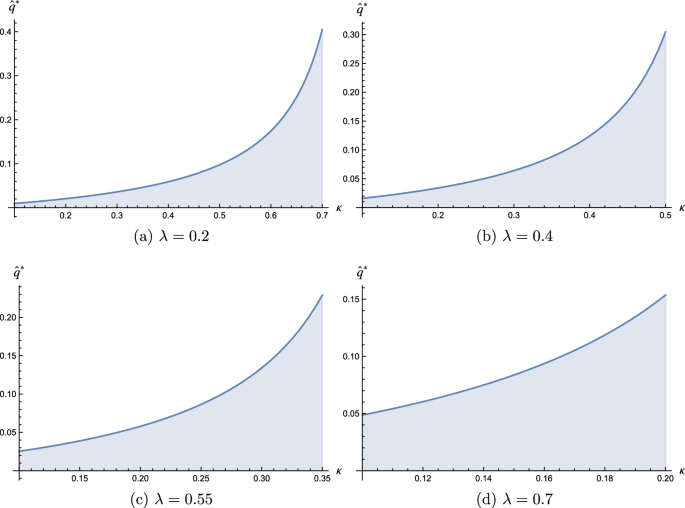

摘要本文表明,由于物质基础收入排除(SBIE),经合组织的第二支柱可能会增加低税国家的就业和投资。SBIE允许从低税率国家的子公司所欠的补足税的税基中两次扣除工资成本和有形资产的使用成本。因此,这意味着如果SBIE为正,则无法实现低税率子公司15%的最低公司税。我们表明,第二支柱抑制了税收激励的转移定价,但改变了就业、投资和进口激励,并且对于足够大的劳动力和/或资本成本份额,SBIE相当于生产补贴。本文章由计算机程序翻译,如有差异,请以英文原文为准。

The economics of the global minimum tax

Abstract This paper shows that OECD’s Pillar Two may increase employment and investment in low-tax countries due to the Substance-based Income Exclusion (SBIE). The SBIE allows to tax-deduct payroll costs and user costs of tangible assets twice from the tax base of the top-up tax owed by subsidiaries in low-tax countries. Consequently, it implies that a 15% minimum corporate tax for low-taxed subsidiaries is not achieved if the SBIE is positive. We show that Pillar Two dampens tax-motivated transfer pricing, but changes the employment, investment and import incentives, and that for a sufficiently large cost share of labor and/or capital, the SBIE is equivalent to a production subsidy.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

International Tax and Public Finance

ECONOMICS-

CiteScore

2.40

自引率

10.00%

发文量

56

期刊介绍:

INTERNATIONAL TAX AND PUBLIC FINANCE publishes outstanding original research, both theoretical and empirical, in all areas of public economics. While the journal has a historical strength in open economy, international, and interjurisdictional issues, we actively encourage high-quality submissions from the breadth of public economics.The special Policy Watch section is designed to facilitate communication between the academic and public policy spheres. This section includes timely, policy-oriented discussions. The goal is to provide a two-way forum in which academic researchers gain insight into current policy priorities and policy-makers can access academic advances in a practical way. INTERNATIONAL TAX AND PUBLIC FINANCE is peer reviewed and published in one volume per year, consisting of six issues, one of which contains papers presented at the annual congress of the International Institute of Public Finance (refereed in the usual way). Officially cited as: Int Tax Public Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: