2019冠状病毒病大流行期间的股息暂停和现金流:一个动态计量模型

IF 9.9

3区 经济学

Q1 ECONOMICS

引用次数: 5

摘要

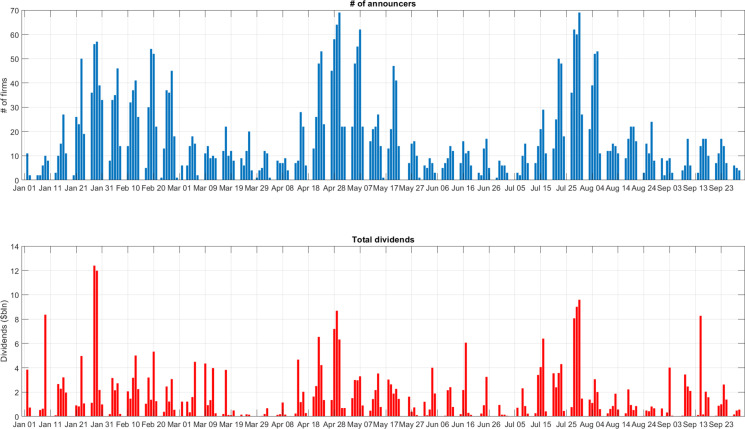

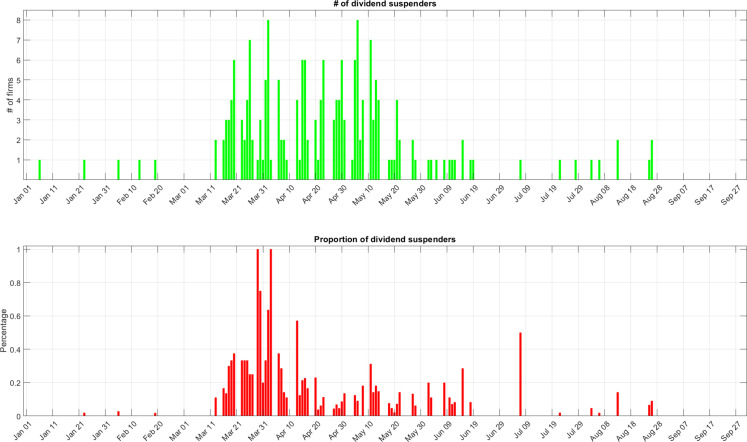

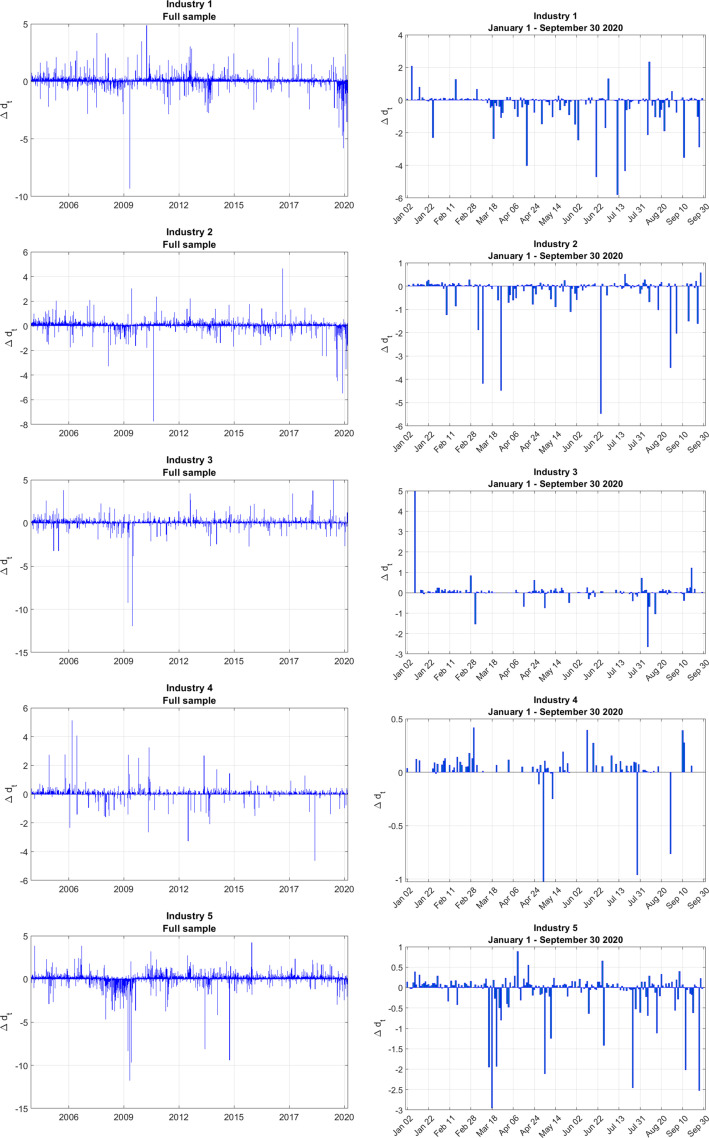

为应对Covid-19大流行的爆发,企业暂停支付前所未有的股息。我们开发了一个多变量动态计量经济模型,该模型允许股息暂停影响每日行业级股息的条件均值、波动性和增长的跳跃概率,并演示了如何使用贝叶斯吉布斯抽样方法估计该模型的参数。我们发现,在每日股息增长的动态和股息暂停的影响方面,各行业存在相当大的异质性。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Dividend suspensions and cash flows during the Covid-19 pandemic: A dynamic econometric model

Firms suspended dividend payments in unprecedented numbers in response to the outbreak of the Covid-19 pandemic. We develop a multivariate dynamic econometric model that allows dividend suspensions to affect the conditional mean, volatility, and jump probability of growth in daily industry-level dividends and demonstrate how the parameters of this model can be estimated using Bayesian Gibbs sampling methods. We find considerable heterogeneity across industries in the dynamics of daily dividend growth and the impact of dividend suspensions.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Econometrics

社会科学-数学跨学科应用

CiteScore

8.60

自引率

1.60%

发文量

220

审稿时长

3-8 weeks

期刊介绍:

The Journal of Econometrics serves as an outlet for important, high quality, new research in both theoretical and applied econometrics. The scope of the Journal includes papers dealing with identification, estimation, testing, decision, and prediction issues encountered in economic research. Classical Bayesian statistics, and machine learning methods, are decidedly within the range of the Journal''s interests. The Annals of Econometrics is a supplement to the Journal of Econometrics.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: