Persistence of investor sentiment and market mispricing

IF 2.6

Q2 BUSINESS, FINANCE

引用次数: 8

Abstract

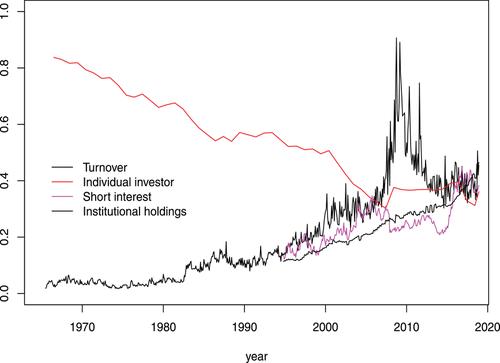

We investigate changes in US market sentiment using structural break analysis over a period of five decades. We show that investor sentiment was trending and nonstationary from 1965 to 2001, a period associated with numerous crashes. Since 2001, sentiment has been substantially more mean reverting, implying the diminished effect of noise investors and their associated mispricing. We illustrate how these changes in sentiment persistence affect equity anomalies and assess the predictive power of sentiment on short-run returns when regime changes are considered. Our findings suggest that the presence of sentiment-driven investors and their market impact is significantly time-variant.

投资者情绪持续和市场错误定价

我们调查了美国市场情绪的变化,使用结构性突破分析在五十年的时间。我们表明,从1965年到2001年,投资者情绪呈趋势且非平稳,这一时期与无数次崩盘有关。自2001年以来,市场情绪明显更加回归均值,这意味着噪音投资者及其相关的错误定价的影响正在减弱。我们说明了情绪持续性的这些变化如何影响股票异常,并评估了当考虑到制度变化时情绪对短期回报的预测能力。我们的研究结果表明,情绪驱动型投资者的存在及其对市场的影响具有显著的时变特征。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: