Adoption factors in digital lending services offered by FinTech lenders

IF 10.8

1区 经济学

Q1 ECONOMICS

引用次数: 2

Abstract

Research background: Traditional financial institutions are facing new competitors ? FinTech lenders. The development of these entities and their services depends on many factors, including the level of their acceptance and use by potential and/or current customers. This acceptance determines the ability to create desired financial results and defines the set of FinTech lenders? activities and also their environment aimed at shaping the offer which meets their consumers? expectations. The limited number of studies addressing the identification and assessment of the impact exerted by the adoption factors of lending services offered by FinTech lenders and the lack of such analyzes relating to these decisions made by consumers from Central and Eastern Europe argue for the need to conduct such research. Purpose of the article: Identify factors driving consumers? adoption of digital lending services offered by FinTech lenders in Poland. Methods: Critical analysis of the source literature, descriptive and comparative analysis, diagnostic survey, econometric methods (PCA, SEM used in the TAM). Empirical data come from the surveys carried out in May 2022 using the CAWI method and covering a representative sample of 1,000 Poles. Findings & value added: The study identified factors driving consumers? adoption of digital lending services, including perceived trust, risk, usefulness and financial health. It has been proven that the perceived ease of use and innovation do not represent the statistically significant constructs influencing the accepted adoption attitudes. The adopted research model shows a considerable power to explain the intention of using digital loans. The article is the first scientific study of this type discussing the identification of adoption factors for loan services offered by FinTech lenders operating on the Central and Eastern European market. The presented example of Poland being the leader in this dynamically developing market provides the background for conducting international comparative studies in the future.金融科技贷款机构提供的数字贷款服务的采用因素

研究背景:传统金融机构面临新的竞争对手?金融科技贷款人。这些实体及其服务的发展取决于许多因素,包括潜在和/或当前客户对其的接受和使用程度。这种接受决定了创造期望财务结果的能力,并定义了金融科技贷款人的集合?活动以及旨在塑造满足消费者需求的产品的环境?期望。针对金融科技贷款人提供的贷款服务的采用因素所产生的影响的识别和评估研究数量有限,而且缺乏与中欧和东欧消费者做出的这些决定相关的分析,因此有必要进行此类研究。文章的目的:识别驱动消费者的因素?采用波兰FinTech贷款人提供的数字贷款服务。方法:对来源文献的批判性分析、描述性和比较分析、诊断性调查、计量经济学方法(TAM中使用的PCA、SEM)。经验数据来自2022年5月使用CAWI方法进行的调查,涵盖了1000名波兰人的代表性样本。调查结果和附加值:该研究确定了推动消费者的因素?采用数字借贷服务,包括感知的信任、风险、有用性和财务健康。事实证明,感知到的易用性和创新性并不能代表影响接受收养态度的统计显著结构。所采用的研究模型显示出相当大的力量来解释使用数字贷款的意图。这篇文章是第一篇此类科学研究,讨论了在中欧和东欧市场运营的金融科技贷款人提供的贷款服务的采用因素的确定。波兰在这个动态发展的市场中处于领先地位的例子为未来进行国际比较研究提供了背景。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

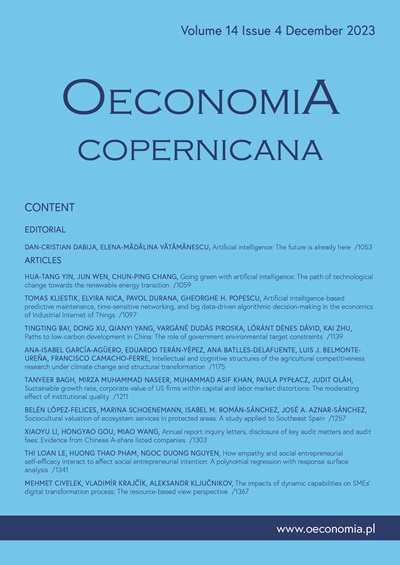

来源期刊

Oeconomia Copernicana

ECONOMICS-

CiteScore

13.70

自引率

5.90%

发文量

26

审稿时长

24 weeks

期刊介绍:

The Oeconomia Copernicana is an academic quarterly journal aimed at academicians, economic policymakers, and students studying finance, accounting, management, and economics. It publishes academic articles on contemporary issues in economics, finance, banking, accounting, and management from various research perspectives. The journal's mission is to publish advanced theoretical and empirical research that contributes to the development of these disciplines and has practical relevance. The journal encourages the use of various research methods, including falsification of conventional understanding, theory building through inductive or qualitative research, first empirical testing of theories, meta-analysis with theoretical implications, constructive replication, and a combination of qualitative, quantitative, field, laboratory, and meta-analytic approaches. While the journal prioritizes comprehensive manuscripts that include methodological-based theoretical and empirical research with implications for policymaking, it also welcomes submissions focused solely on theory or methodology.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: