Coordinated monitoring and mergers and acquisitions

IF 2.1

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

Abstract

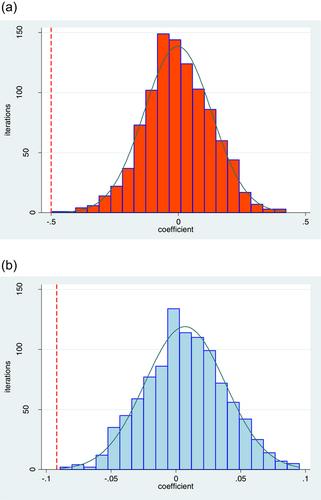

This paper shows that coordinated monitoring by institutional investors affects how firms behave in the M&A market. We employ the spatial dimension of geographic links between major institutions as a proxy for interaction and information exchange—a process that determines the effectiveness of investor monitoring over firm management. Using data over the last 30 years, we show that the returns to acquiring shareholders are significantly higher, and M&A activity is significantly more intense when institutions coordinate better their monitoring efforts. Our results are robust to series of tests to gauge their sensitivity to different model specifications and estimation procedures.

协调监测和并购

本文表明,机构投资者的协同监督影响着企业在并购市场中的行为。我们采用主要机构之间地理联系的空间维度作为互动和信息交换的代理——这一过程决定了投资者对公司管理监督的有效性。利用过去30年的数据,我们发现,当机构更好地协调其监测工作时,收购股东的回报显著更高,并购活动明显更激烈。我们的结果是稳健性的一系列测试,以衡量他们的敏感性不同的模型规格和估计程序。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

European Financial Management

BUSINESS, FINANCE-

CiteScore

4.30

自引率

18.20%

发文量

60

期刊介绍:

European Financial Management publishes the best research from around the world, providing a forum for both academics and practitioners concerned with the financial management of modern corporation and financial institutions. The journal publishes signficant new finance research on timely issues and highlights key trends in Europe in a clear and accessible way, with articles covering international research and practice that have direct or indirect bearing on Europe.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: