Enabling Short-Term Energy Flexibility Markets Through Blockchain

IF 4.1

3区 计算机科学

Q2 COMPUTER SCIENCE, INFORMATION SYSTEMS

引用次数: 0

Abstract

Climate change has put significant pressure on energy markets. Political decisions such as the plan of the German government to shut down coal power plants by 2038 are shifting electricity production towards renewable and distributed energy resources. The share of these resources will continue to grow significantly in the coming years. This trend changes the ways how energy markets work which mandates fundamental changes in the underlying IT infrastructure. In this paper, we propose a blockchain-based solution which enables an economically viable and grid-serving integration of distributed energy resources into the existing energy system. Our blockchain-based approach targets intraday and day-ahead operating reserve markets, on which energy grid operators and operators of distributed energy resources can trade flexibilities within the schedulable energy production and consumption of their resources. By utilizing these flexibilities as an operating reserve, renewable and climate-friendly technologies can contribute to maintaining the grid stability and security of supply while simultaneously creating economically interesting business models for their operators. We propose to define blockchain-based short-term energy markets by utilizing the concept of general-purpose smart contracts and cryptocurrencies. This enables direct and decentralized trading of energy flexibilities without any intermediary or central instance. We demonstrate the feasibility of our approach through an implementation of a prototype of the proposed markets based on the Ethereum blockchain and provide a detailed evaluation of its efficiency and scalability.通过bbb实现短期能源灵活性市场

气候变化给能源市场带来了巨大压力。德国政府计划在2038年前关闭燃煤电厂等政治决策,正在将电力生产转向可再生能源和分布式能源。这些资源的份额在未来几年将继续显著增长。这一趋势改变了能源市场的运作方式,要求对底层IT基础设施进行根本性的改变。在本文中,我们提出了一种基于区块链的解决方案,该解决方案能够将分布式能源整合到现有的能源系统中,从而实现经济上可行的并网服务。我们基于区块链的方法针对当日和日前运营储备市场,在这个市场上,能源电网运营商和分布式能源运营商可以在可调度的能源生产和资源消耗范围内交易灵活性。通过利用这些灵活性作为运营储备,可再生能源和气候友好型技术可以有助于维护电网的稳定性和供应安全,同时为运营商创造经济上有趣的商业模式。我们建议利用通用智能合约和加密货币的概念来定义基于区块链的短期能源市场。这使得能源灵活性的直接和分散交易无需任何中介或中心实例。我们通过实施基于以太坊区块链的拟议市场原型来证明我们方法的可行性,并对其效率和可扩展性进行了详细评估。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

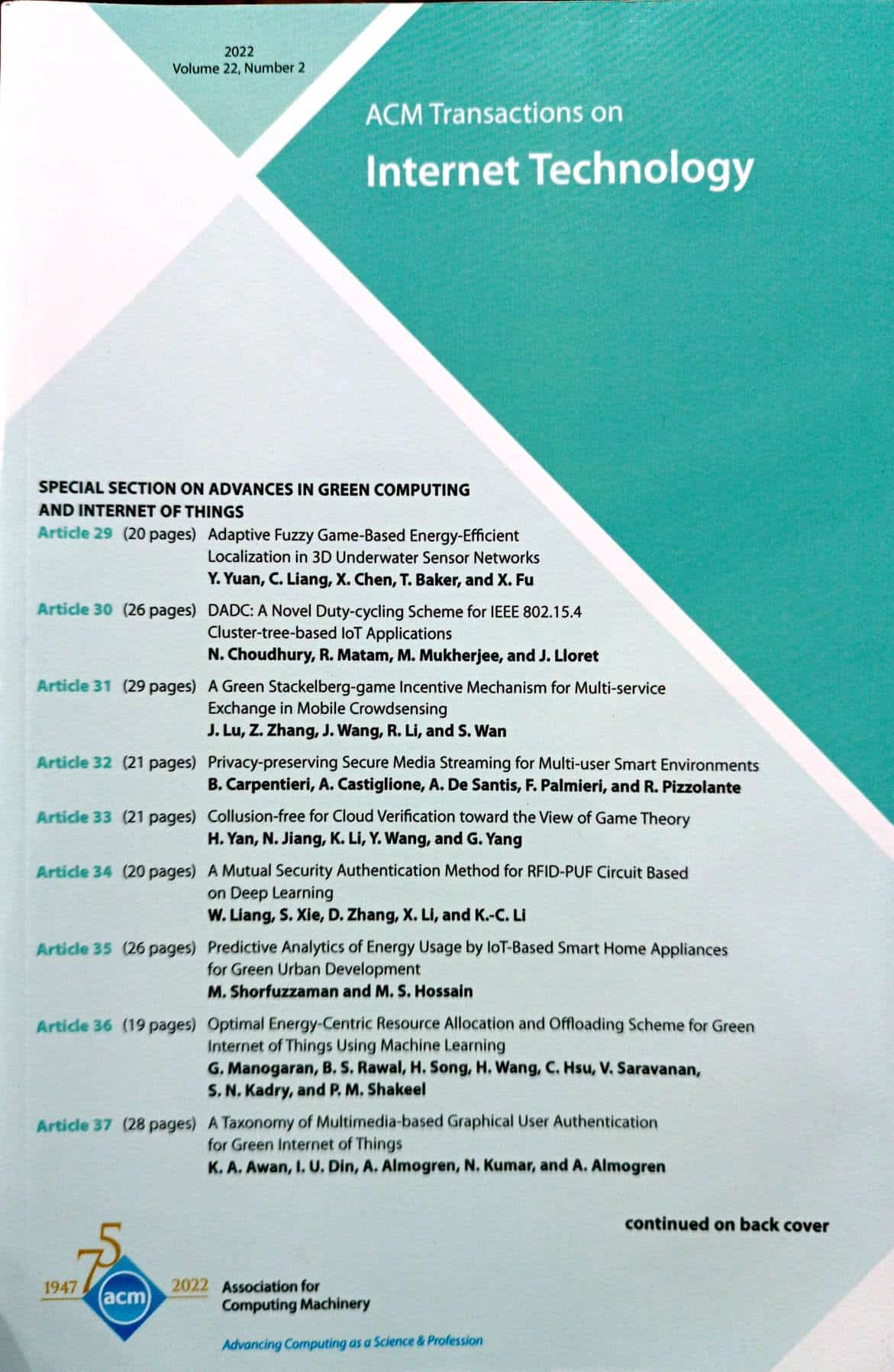

来源期刊

ACM Transactions on Internet Technology

工程技术-计算机:软件工程

CiteScore

10.30

自引率

1.90%

发文量

137

审稿时长

>12 weeks

期刊介绍:

ACM Transactions on Internet Technology (TOIT) brings together many computing disciplines including computer software engineering, computer programming languages, middleware, database management, security, knowledge discovery and data mining, networking and distributed systems, communications, performance and scalability etc. TOIT will cover the results and roles of the individual disciplines and the relationshipsamong them.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: