Covid-19 and smart beta: A case study on the role of sectors.

IF 1.8

Q3 BUSINESS, FINANCE

Financial Markets and Portfolio Management

Pub Date : 2021-01-01

Epub Date: 2021-04-15

DOI:10.1007/s11408-021-00383-7

引用次数: 2

Abstract

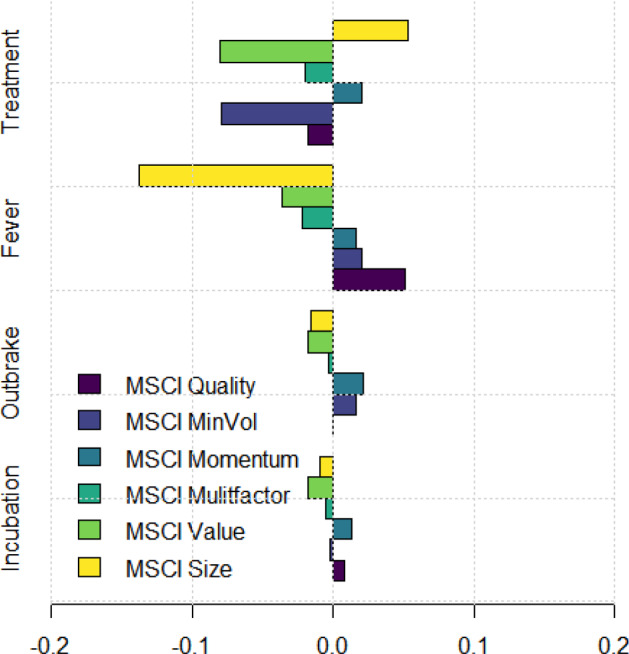

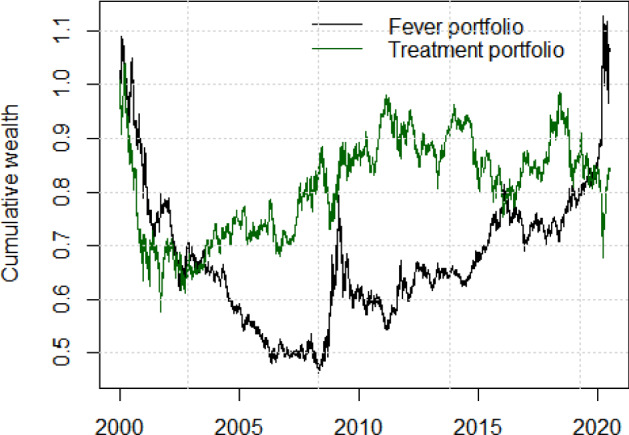

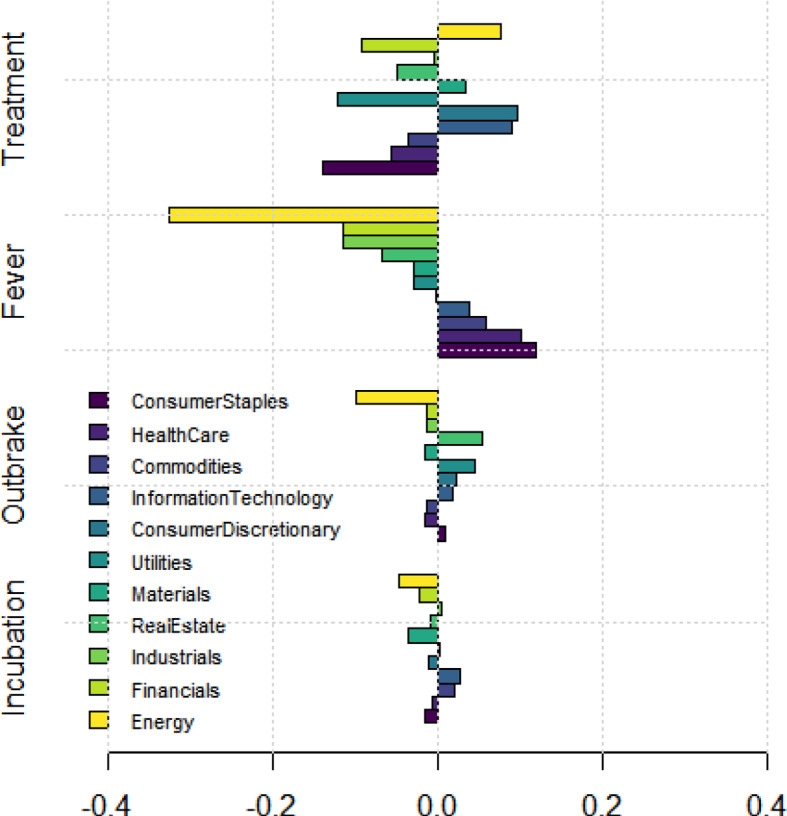

We investigate the role of sectors on the performance of smart beta products during the COVID-19 crisis. Cross-sectional differences in excess returns (versus a market capitalized portfolio) are driven by strong exposures to COVID-19-related industry rotation, rather than to long-term structural causes.

Covid-19与智能beta:部门作用的案例研究。

我们调查了在COVID-19危机期间行业对智能beta产品性能的作用。超额回报(相对于市值投资组合)的横截面差异是由与covid -19相关的行业轮转的严重风险造成的,而不是由长期结构性原因造成的。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Financial Markets and Portfolio Management

BUSINESS, FINANCE-

CiteScore

3.20

自引率

0.00%

发文量

21

期刊介绍:

The journal Financial Markets and Portfolio Management invites submissions of original research articles in all areas of finance, especially in – but not limited to – financial markets, portfolio choice and wealth management, asset pricing, risk management, and regulation. Its principal objective is to publish high-quality articles of innovative research and practical application. The readers of Financial Markets and Portfolio Management are academics and professionals in finance and economics, especially in the areas of asset management. FMPM publishes academic and applied research articles, shorter ''Perspectives'' and survey articles on current topics of interest to the financial community, as well as book reviews. All article submissions are subject to a double-blind peer review. http://www.fmpm.org

Officially cited as: Financ Mark Portf Manag

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: