Dynamic Linkages and Temporal Relationships Between Spot and Future Index Prices: Empirical Evidence from India Using Non-linear GARCH–BEKK

Abstract

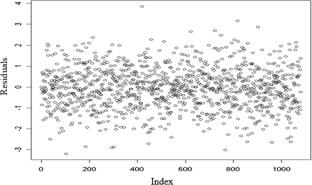

This study empirically examines price discovery and volatility spillover between the spot and futures markets for India using both daily and intraday data of Nifty50 and its associated futures index. Within the Johansen cointegration framework, the study for the first time used the recursive cointegration method for examining the dynamics of the long-run relationship between the equity spot and futures markets. To analyze the volatility spillovers between the two markets the study employs BEKK–GARCH model. This model ensures the positive definiteness of the conditional covariance matrix and estimates the same with less number of parameters as compared to the traditional multivariate GARCH models including the VECH model. The empirical results show that there is a stable long-run relationship between the two markets. The Granger causality findings support the notion that the futures market plays a dominant role in causal relationships. There is also a two-way volatility spillover between the two markets. However, it is relatively seen that the futures market has strong transmission effects which are carried over to the spot market. This is intuitive because the futures market is more sensitive to new information than its counterpart due to differences in cost and liquidity. The results based on the latest data, offer a new perspective on the lead–lag relationship between India’s stock market futures prices and spot prices. These findings can benefit stock market stakeholders by protecting themselves from uncertainty and developing futures contracts that will increase the efficiency of the Indian equity market.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: