Data patterns that reliably precede US recessions

IF 3.4

3区 经济学

Q1 ECONOMICS

引用次数: 0

Abstract

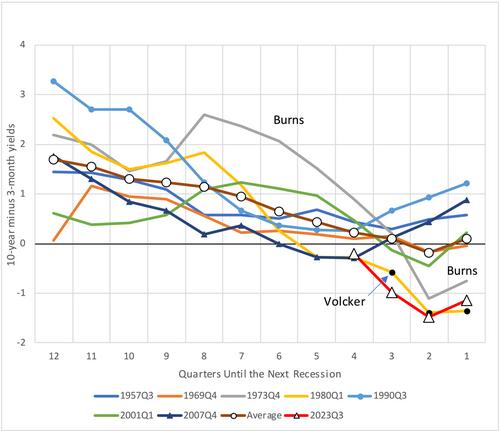

This paper proposes a method of forecasting US recessions beginning with data displays that contain the last 12 quarters of seven US expansions. These end-of-expansion displays allow observers to see for themselves what is different about the last year before recessions compared with the two earlier years. Using a statistical model that treats this historical data as draws from a 12-dimensional multivariate normal distribution, the most recent data are probabilistically inserted into these images where the recent data are most like the historical data. This is a recession forecast based not on presumed patterns but on patterns revealed by the data.

美国经济衰退前的可靠数据模式

本文提出了一种预测美国经济衰退的方法,首先是包含美国七次经济扩张的最后 12 个季度的数据显示。这些扩张末期的数据显示可以让观察者亲眼看到衰退前最后一年与衰退前两年的不同之处。利用一个统计模型,将这些历史数据视为从 12 维多元正态分布中抽取的数据,在最近数据与历史数据最相似的地方,以概率方式将最新数据插入这些图像中。这种衰退预测不是基于假定的模式,而是基于数据揭示的模式。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Forecasting

Multiple-

CiteScore

5.40

自引率

5.90%

发文量

91

期刊介绍:

The Journal of Forecasting is an international journal that publishes refereed papers on forecasting. It is multidisciplinary, welcoming papers dealing with any aspect of forecasting: theoretical, practical, computational and methodological. A broad interpretation of the topic is taken with approaches from various subject areas, such as statistics, economics, psychology, systems engineering and social sciences, all encouraged. Furthermore, the Journal welcomes a wide diversity of applications in such fields as business, government, technology and the environment. Of particular interest are papers dealing with modelling issues and the relationship of forecasting systems to decision-making processes.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: