SOFR term structure dynamics—Discontinuous short rates and stochastic volatility forward rates

IF 1.8

4区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

Abstract

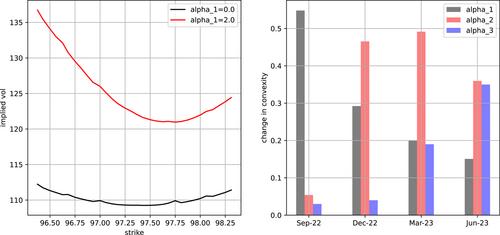

The Secured Overnight Funding Rate (SOFR) has become the risk-free rate benchmark in US dollars, thus term structure models should reflect key features exhibited by SOFR and forward rates implied by SOFR futures. We construct a multifactor, stochastic volatility term structure model which incorporates these features. Calibrating to options on SOFR futures, we achieve a reasonable fit to the market across maturities and strikes in a single model. This also provides novel insights into SOFR term rate behavior (and implied volatilities) within their accrual periods, and a model mechanism by which interest rate mean reversion arises from monetary policy.

SOFR 期限结构动态--非连续短期利率和随机波动远期利率

有担保隔夜拆借利率(SOFR)已成为美元的无风险利率基准,因此期限结构模型应反映出有担保隔夜拆借利率和有担保隔夜拆借利率期货所隐含的远期利率的主要特征。我们构建了一个包含这些特征的多因素随机波动率期限结构模型。通过对 SOFR 期货期权进行校准,我们在单一模型中实现了对不同期限和行权价市场的合理拟合。这也为 SOFR 期货在应计期内的利率行为(和隐含波动率)提供了新的见解,以及货币政策导致利率均值回归的模型机制。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Futures Markets

BUSINESS, FINANCE-

CiteScore

3.70

自引率

15.80%

发文量

91

期刊介绍:

The Journal of Futures Markets chronicles the latest developments in financial futures and derivatives. It publishes timely, innovative articles written by leading finance academics and professionals. Coverage ranges from the highly practical to theoretical topics that include futures, derivatives, risk management and control, financial engineering, new financial instruments, hedging strategies, analysis of trading systems, legal, accounting, and regulatory issues, and portfolio optimization. This publication contains the very latest research from the top experts.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: