Futures trading costs and market microstructure invariance: Identifying bet activity

IF 1.8

4区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

Abstract

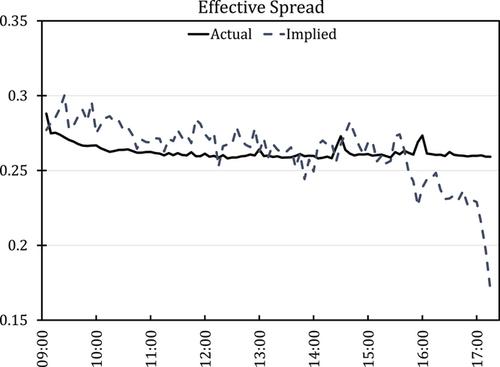

Market microstructure invariance (MMI) stipulates that trading costs of financial assets are driven by the volume and volatility of bets, but these variables are inherently difficult to identify. With futures transactions data, we estimate bet volume as the trading volume of brokerage firms that trade on behalf of their clients and bet volatility as the trade-related component of futures volatility. We find that the futures bid–ask spread lines up with bet volume and bet volatility as predicted by MMI, and that intermediation by high-frequency traders does not interfere with the MMI relation.

期货交易成本与市场微观结构不变性:识别投注活动

市场微观结构不变性(MMI)规定,金融资产的交易成本受投注量和波动率的影响,但这些变量本身难以确定。利用期货交易数据,我们将投注量估算为代表客户进行交易的经纪公司的交易量,将投注波动率估算为期货波动率中与交易相关的部分。我们发现,正如 MMI 所预测的那样,期货买卖价差与投注量和投注波动性一致,而且高频交易者的中介作用不会干扰 MMI 关系。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Futures Markets

BUSINESS, FINANCE-

CiteScore

3.70

自引率

15.80%

发文量

91

期刊介绍:

The Journal of Futures Markets chronicles the latest developments in financial futures and derivatives. It publishes timely, innovative articles written by leading finance academics and professionals. Coverage ranges from the highly practical to theoretical topics that include futures, derivatives, risk management and control, financial engineering, new financial instruments, hedging strategies, analysis of trading systems, legal, accounting, and regulatory issues, and portfolio optimization. This publication contains the very latest research from the top experts.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: