Forecasting realized volatility of crude oil futures prices based on machine learning

IF 3.4

3区 经济学

Q1 ECONOMICS

引用次数: 0

Abstract

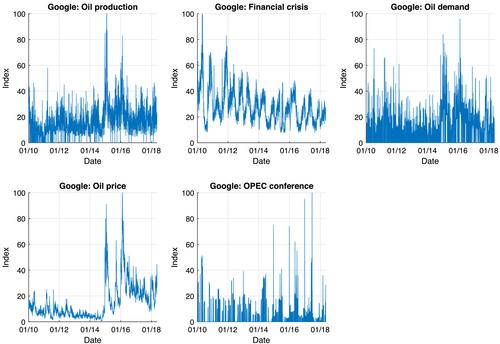

Extending the popular HAR model with additional information channels to forecast realized volatility of WTI futures prices, we show that machine learning-generated forecasts provide better forecasting quality and that portfolios that are constructed with these forecasts outperform their competing models resulting in economic gains. Analyzing the selection process, we show that information channels vary across forecasting horizon. Variable selection produces clusters and provides evidence that there are structural changes with regard to the significance of information channels.

基于机器学习预测原油期货价格的实际波动率

我们用额外的信息渠道扩展了流行的 HAR 模型,以预测 WTI 期货价格的已实现波动率,结果表明机器学习生成的预测提供了更好的预测质量,用这些预测构建的投资组合优于其竞争模型,从而带来经济收益。在分析选择过程时,我们发现信息渠道在不同的预测范围内会有所不同。变量选择会产生集群,并证明信息渠道的重要性存在结构性变化。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Forecasting

Multiple-

CiteScore

5.40

自引率

5.90%

发文量

91

期刊介绍:

The Journal of Forecasting is an international journal that publishes refereed papers on forecasting. It is multidisciplinary, welcoming papers dealing with any aspect of forecasting: theoretical, practical, computational and methodological. A broad interpretation of the topic is taken with approaches from various subject areas, such as statistics, economics, psychology, systems engineering and social sciences, all encouraged. Furthermore, the Journal welcomes a wide diversity of applications in such fields as business, government, technology and the environment. Of particular interest are papers dealing with modelling issues and the relationship of forecasting systems to decision-making processes.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: