Managing other people's money: An agency theory in financial management industry

IF 2.1

3区 经济学

Q3 BUSINESS, FINANCE

引用次数: 0

Abstract

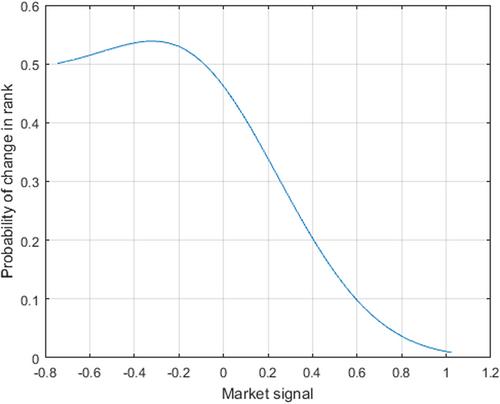

We build an active asset management model to study the interplay between the career concerns of a manager and prevailing market conditions. We show that fund managers overinvest in market-neutral strategies, as these have a reputational benefit. This benefit is smaller in bull markets, when investors expect more managers to use high-beta strategies, making their performance less informative about their ability than in bear markets. Consequently, fund flows that follow high-beta strategies are less responsive to the fund's performance, and flow-performance sensitivity is higher in bear markets than in bull markets.

管理他人的钱:财务管理行业的代理理论

我们建立了一个主动资产管理模型来研究经理的职业生涯关注和当前市场状况之间的相互作用。我们表明,基金经理过度投资于市场中性策略,因为这些策略具有声誉效益。在牛市中,这种好处较小,因为投资者期望更多的经理使用高贝塔策略,这使得他们的表现不像在熊市中那样能反映出他们的能力。因此,遵循高贝塔策略的资金流对基金业绩的反应较弱,而且在熊市中资金流对业绩的敏感性高于牛市。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Financial Research

BUSINESS, FINANCE-

CiteScore

1.70

自引率

0.00%

发文量

0

期刊介绍:

The Journal of Financial Research(JFR) is a quarterly academic journal sponsored by the Southern Finance Association (SFA) and the Southwestern Finance Association (SWFA). It has been continuously published since 1978 and focuses on the publication of original scholarly research in various areas of finance such as investment and portfolio management, capital markets and institutions, corporate finance, corporate governance, and capital investment. The JFR, also known as the Journal of Financial Research, provides a platform for researchers to contribute to the advancement of knowledge in the field of finance.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: