VAT pass-through: the case of a large and permanent reduction in the market for menstrual hygiene products

IF 1.4

4区 经济学

Q3 ECONOMICS

引用次数: 0

Abstract

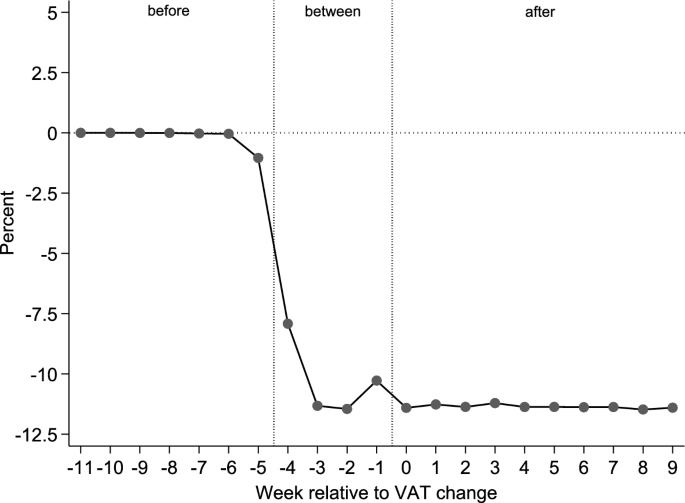

This paper examines the price effects of a VAT (value-added tax) reduction for menstrual hygiene products in Germany. Several aspects make this VAT reduction particularly interesting: the reduction is exogenous to economic conditions, the reduction was substantial and permanent, and demand can be assumed to be inelastic. We find that the VAT reduction was completely passed through to consumers. In fact, pass-through rates of significantly more than 100% can be observed. We find that the excess pass-through occurred in relatively competitive market segments, and that it is almost fully explained by retailers rounding down prices after the reduction.

增值税的传递:一个大的和永久的减少在市场上的月经卫生用品的情况

本文考察了德国月经卫生产品增值税(增值税)减免的价格效应。有几个方面使增值税的减少特别有趣:减少是外生的经济条件,减少是实质性的和永久性的,需求可以被认为是无弹性的。我们发现增值税的减少完全转嫁给了消费者。事实上,可以观察到明显超过100%的通过率。我们发现,这种过度传递发生在竞争相对激烈的细分市场,而零售商在降价后将价格四舍五入几乎可以完全解释这一点。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

International Tax and Public Finance

ECONOMICS-

CiteScore

2.40

自引率

10.00%

发文量

56

期刊介绍:

INTERNATIONAL TAX AND PUBLIC FINANCE publishes outstanding original research, both theoretical and empirical, in all areas of public economics. While the journal has a historical strength in open economy, international, and interjurisdictional issues, we actively encourage high-quality submissions from the breadth of public economics.The special Policy Watch section is designed to facilitate communication between the academic and public policy spheres. This section includes timely, policy-oriented discussions. The goal is to provide a two-way forum in which academic researchers gain insight into current policy priorities and policy-makers can access academic advances in a practical way. INTERNATIONAL TAX AND PUBLIC FINANCE is peer reviewed and published in one volume per year, consisting of six issues, one of which contains papers presented at the annual congress of the International Institute of Public Finance (refereed in the usual way). Officially cited as: Int Tax Public Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: