The cash-secured put-write strategy and the variance risk premium

IF 1.4

Q3 BUSINESS, FINANCE

引用次数: 0

Abstract

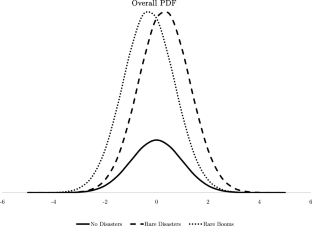

A cash-secured put-write (PUTW) strategy involves writing an at-the-money put option and setting aside enough cash to buy the underlying. Empirically, the PUTW returns outperform the returns predicted by the traditional one- three- and five-factor models. We explain the outperformance. A model where the market is subject to disasters generates a Variance Risk Premium (VRP), which reflects information about both the risk aversion and the impact of disasters. VRP, when added to the market factor, accounts for the PUTW outperformance. This factor also explains abnormal returns for other derivative strategies.

现金担保的看跌策略和方差风险溢价

现金担保看跌期权(PUTW)策略包括卖出一个平价看跌期权,并预留足够的现金购买标的期权。从经验上看,PUTW的回报优于传统的一-三和五因素模型预测的回报。我们解释了这种优异的表现。当市场受灾害影响时,模型会产生方差风险溢价(VRP),它反映了风险规避和灾害影响的信息。VRP,当加上市场因素时,解释了PUTW的优异表现。这一因素也解释了其他衍生品策略的异常回报。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Asset Management

BUSINESS, FINANCE-

CiteScore

4.10

自引率

0.00%

发文量

44

期刊介绍:

The Journal of Asset Management covers:new investment strategies, methodologies and techniquesnew products and trading developmentsimportant regulatory and legal developmentsemerging trends in asset managementUnder the guidance of its expert Editors and an eminent international Editorial Board, Journal of Asset Management has developed to provide an international forum for latest thinking, techniques and developments for the Fund Management Industry, from high-growth investment strategies to modelling and managing risk, from active management to index tracking. The Journal has established itself as a key bridge between applied academic research, commercial best practice and regulatory interests, globally.Each issue of Journal of Asset Management publishes detailed, authoritative briefings, analysis, research and reviews by leading experts in the field, to keep subscribers up to date with the latest developments and thinking in asset management.Journal of Asset Management covers:asset allocation hedge fund strategies risk definition and management index tracking performance measurement stock selection investment methodologies and techniques portfolio management and weighting product development and innovation active asset management style analysis strategies to match client profiles time horizons emerging markets alternative investments derivatives and hedging instruments pensions economics

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: