All losses are not alike: Real versus accounting-driven reported losses

IF 4.8

3区 管理学

Q1 BUSINESS, FINANCE

引用次数: 5

Abstract

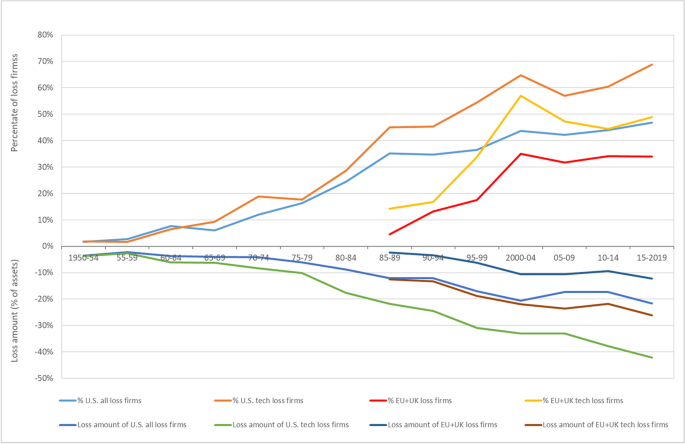

Abstract We examine the value relevance of accounting-driven losses that result from the immediate expensing of firms’ internally generated intangible investments versus losses occurring irrespective of intangible investments. Contrary to the long-held view that losses are less relevant than profits for valuation, we find that once the accounting bias of intangibles-expensing is undone, earnings of firms reporting intangibles-driven losses are as informative as earnings of profitable firms. Furthermore, contrary to the view that persistent losses decrease earnings relevance, our evidence shows no decrease in the relevance of earnings for firms reporting persistent intangibles-driven losses. We also find that firms reporting intangibles-driven losses subsequently outperform other loss firms and even profitable firms in value creation from investments in technological innovation and human capital. Our evidence further shows that firms reporting intangibles-driven losses have stronger future performance than other firms. Taken together, the results of this study demonstrate the fundamental differences between losses driven by the immediate expensing of internally generated intangible investments and losses reflecting genuine business performance shortfalls. Standard accounting performance measures, however, do not properly reflect these operational differences and their implications.

所有的损失都是不一样的:真实的损失和会计驱动的报告损失

摘要:我们研究了会计驱动损失的价值相关性,这些损失是由公司内部产生的无形投资的直接费用引起的,与无形投资无关。与长期以来认为损失与估值的相关性不如利润的观点相反,我们发现,一旦无形费用的会计偏见被消除,报告无形驱动损失的公司的收益与盈利公司的收益一样具有信息性。此外,与持续亏损降低盈利相关性的观点相反,我们的证据显示,报告持续无形驱动亏损的公司的盈利相关性没有下降。我们还发现,报告无形损失的公司随后在技术创新和人力资本投资的价值创造方面优于其他亏损公司,甚至优于盈利公司。我们的证据进一步表明,报告无形资产驱动损失的公司比其他公司有更强的未来表现。综上所述,本研究的结果表明,由内部产生的无形投资的直接费用驱动的损失与反映真正的业务绩效不足的损失之间存在根本差异。然而,标准会计绩效衡量标准并不能恰当地反映这些操作差异及其影响。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Review of Accounting Studies

BUSINESS, FINANCE-

CiteScore

7.90

自引率

7.10%

发文量

82

期刊介绍:

Review of Accounting Studies provides an outlet for significant academic research in accounting including theoretical, empirical, and experimental work. The journal is committed to the principle that distinctive scholarship is rigorous. While the editors encourage all forms of research, it must contribute to the discipline of accounting. The Review of Accounting Studies is committed to prompt turnaround on the manuscripts it receives. For the majority of manuscripts the journal will make an accept-reject decision on the first round. Authors will be provided the opportunity to revise accepted manuscripts in response to reviewer and editor comments; however, discretion over such manuscripts resides principally with the authors. An editorial revise and resubmit decision is reserved for new submissions which are not acceptable in their current version, but for which the editor sees a clear path of changes which would make the manuscript publishable. Officially cited as: Rev Account Stud

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: