Optimisation of drawdowns by generalised reinsurance in the classical risk model

IF 0.7

Q3 SOCIAL SCIENCES, MATHEMATICAL METHODS

引用次数: 0

Abstract

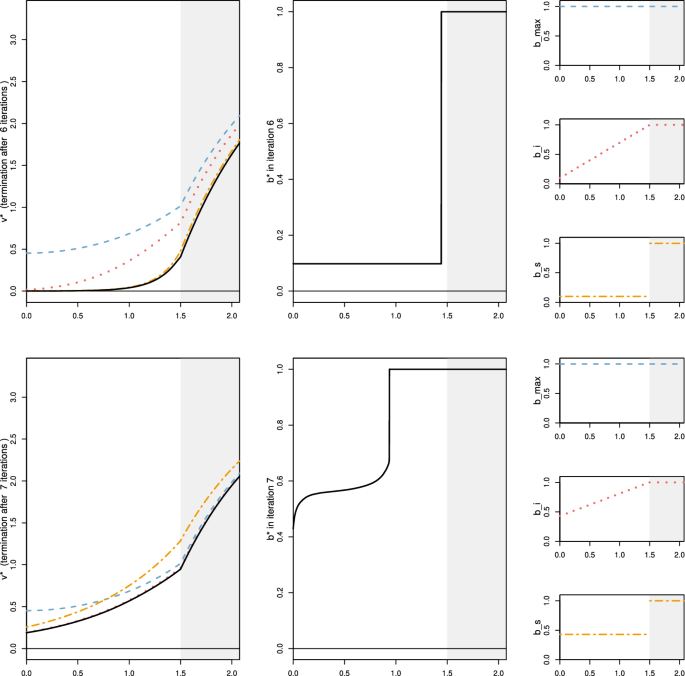

Abstract We consider a Cramér–Lundberg model representing the surplus of an insurance company under a general reinsurance control process. We aim to minimise the expected time during which the surplus is bounded away from its own running maximum by at least $$d>0$$

经典风险模型中广义再保险的赔付优化

摘要考虑一般再保险控制过程下保险公司盈余的cram r - lundberg模型。我们的目标是使盈余偏离其自身运行最大值的预期时间至少缩短$$d>0$$ d >0(以优惠率贴现$$\delta >0$$ δ >0)通过选择再保险策略。通过直接分析收缩过程(即控制盈余模型到其最大值的绝对距离),我们证明了价值函数满足相应的Hamilton-Jacobi-Bellman方程,并展示了如何计算价值函数和最优策略。如果初始衰减非常大,则问题对应于一段时间的拉普拉斯变换的最大化。我们表明,恒定的留存水平是最理想的。如果收缩小于d,则问题可以表示为一组Gerber-Shiu优化问题的一个元素。我们展示了如何解决这些问题,以及最优策略是反馈形式。我们通过轻尾索赔和重尾索赔的案例来说明这一理论。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Decisions in Economics and Finance

SOCIAL SCIENCES, MATHEMATICAL METHODS-

CiteScore

2.50

自引率

9.10%

发文量

10

期刊介绍:

Decisions in Economics and Finance: A Journal of Applied Mathematics is the official publication of the Association for Mathematics Applied to Social and Economic Sciences (AMASES). It provides a specialised forum for the publication of research in all areas of mathematics as applied to economics, finance, insurance, management and social sciences. Primary emphasis is placed on original research concerning topics in mathematics or computational techniques which are explicitly motivated by or contribute to the analysis of economic or financial problems.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: