Long waves, paradigm shifts, and income distribution, 1929–2010 and afterwards

IF 1.8

4区 经济学

Q3 ECONOMICS

引用次数: 1

Abstract

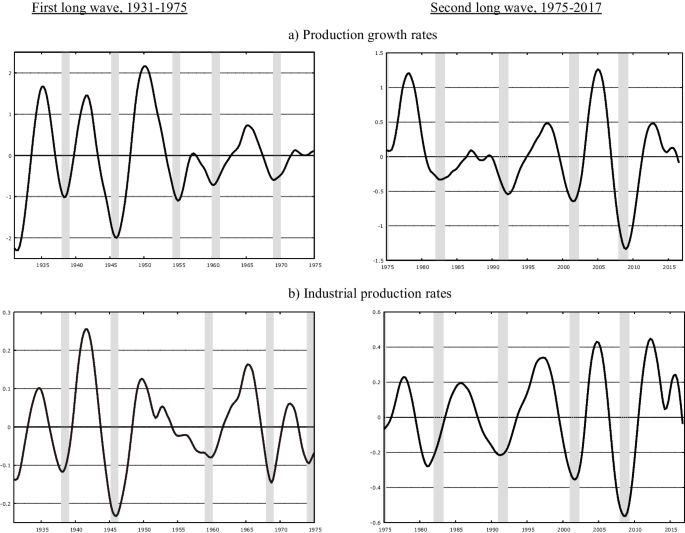

Abstract The way income is distributed in an economy is perhaps the most notable result of its growth patterns. Understanding the joint persistence of economic crises and changes in social inequality since 1929 is considered a great challenge. This paper tries to analyze growth and income distribution in the long run using the concept of long waves, the evolutionary concept of ‘systems’, and empirical information. We conjecture that the social system is in turn an outcome of the co-evolution of four partially autonomous subdomains: (i) technology, characterized by a paradigm whose evolution follows the shape of a ‘Schumpeterian boom’; (ii) the economy or productive system, essentially defined as the succession of intermediate-length fluctuations in investments, and strongly associated to sectoral and structural changes; (iii) science, which contributes to development by generating innovations; and (iv) institutions, which set the rules in which income distribution is framed. Following this scheme, the data reveal that income distribution is an emerging result from this ‘global social system’ and not only the result of economic productivity and technology; apparently, the weight in the income distribution of institutional factors is as relevant as economic and technological factors. Second, the long-run growth trends are most possibly non-linear and, to great extent, non-deterministic, which would support the representation of long-run phenomena as long waves. Finally, we have found that in the long period 1929–2010 and afterwards, two sub-periods are manifested, with very different regimes of income distribution: (1) 1929–1975, when inequality decreased, and (2) from 1975 to present time, when inequality increased. Concerning the years after 2010, two alternatives follow: either these correspond to the recovery phase of a new long wave, or to the end of the depression phase of our second period. In both cases, we are currently moving towards the expansionary phase of a new long wave, which will have important implications for contemporary economic policies.

1929-2010年及之后的长波、范式转换和收入分配

一个经济体的收入分配方式可能是其增长模式最显著的结果。理解1929年以来持续不断的经济危机和社会不平等的变化被认为是一个巨大的挑战。本文试图利用长波的概念、“系统”的进化概念和经验信息来分析长期的增长和收入分配。我们推测,社会系统反过来是四个部分自治的子领域共同进化的结果:(i)技术,其特征是范式的进化遵循“熊彼特繁荣”的形状;(二)经济或生产系统,基本上定义为投资的中等长度波动的连续,并与部门和结构变化密切相关;(三)科学,通过创新促进发展;(四)制定收入分配框架规则的制度。根据这一方案,数据显示,收入分配是“全球社会体系”的新兴结果,而不仅仅是经济生产力和技术的结果;显然,制度因素在收入分配中的权重与经济和技术因素同样重要。其次,长期增长趋势很可能是非线性的,而且在很大程度上是不确定的,这将支持将长期现象表示为长波。最后,我们发现,在1929-2010年及之后的长时期内,收入分配制度非常不同,表现为两个子时期:(1)1929-1975年,不平等程度下降;(2)1975年至今,不平等程度增加。关于2010年之后的年份,有两种选择:要么对应于新长波的复苏阶段,要么对应于第二个时期萧条阶段的结束。在这两种情况下,我们目前正走向新的长波的扩张阶段,这将对当代经济政策产生重要影响。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Evolutionary Economics

ECONOMICS-

CiteScore

3.60

自引率

5.60%

发文量

39

期刊介绍:

The journal aims to provide an international forum for a new approach to economics. Following the tradition of Joseph A. Schumpeter, it is designed to focus on original research with an evolutionary conception of the economy. The journal will publish articles with a strong emphasis on dynamics, changing structures (including technologies, institutions, beliefs and behaviours) and disequilibrium processes with an evolutionary perspective (innovation, selection, imitation, etc.). It favours interdisciplinary analysis and is devoted to theoretical, methodological and applied work. Research areas include: industrial dynamics; multi-sectoral and cross-country studies of productivity; innovations and new technologies; dynamic competition and structural change in a national and international context; causes and effects of technological, political and social changes; cyclic processes in economic evolution; the role of governments in a dynamic world; modelling complex dynamic economic systems; application of concepts, such as self-organization, bifurcation, and chaos theory to economics; evolutionary games. Officially cited as: J Evol Econ

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: