Stabilising market expectations through a market tool: a proposal for an enhanced TPI

IF 2.8

4区 经济学

Q1 ECONOMICS

引用次数: 0

Abstract

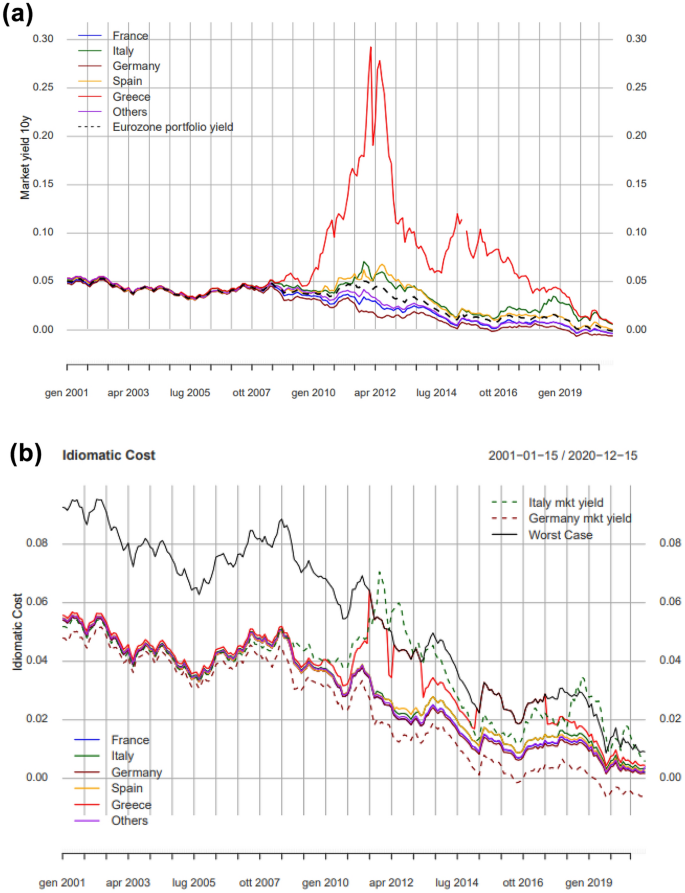

Abstract This paper puts forward a proposal to complete the ECB Transmission Protection Instrument (TPI) with the aim of making it more effective in anchoring the yields of European sovereign debts to Member States’ fundamentals. We use a model in which yields fluctuate within bands, which we specify following two alternative approaches: stochastic and deterministic. The resulting fluctuation's interval represents the range of yields that can be seen as justified by Member States’ fundamentals; yields outside the band would instead trigger the ECB intervention as foreseen by the TPI. The proposal minimizes the risk of moral hazard, as the fluctuation bands vary as each country's creditworthiness changes. Moreover, the proposal is directly implementable with existing Treaties.

通过市场工具稳定市场预期:提高TPI的建议

摘要本文提出了完善欧洲央行传导保护工具(TPI)的建议,旨在使其更有效地将欧洲主权债务的收益率锚定在成员国的基本面上。我们使用收益率在区间内波动的模型,我们指定以下两种替代方法:随机和确定性。由此产生的波动间隔代表了从会员国的基本情况来看是合理的收益范围;相反,区间外的收益率将触发欧洲央行的干预,正如TPI所预测的那样。该提议最大限度地降低了道德风险,因为波动幅度会随着每个国家信誉的变化而变化。此外,该建议可与现有条约直接执行。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Economia Politica

ECONOMICS-

CiteScore

3.90

自引率

5.60%

发文量

34

期刊介绍:

This journal publishes peer-reviewed articles that link theory and analysis in political economy, promoting a deeper understanding of economic realities and more effective courses of policy action. Established in 1984, the journal has kept pace with the times in disseminating high-quality and influential research aimed at establishing fruitful links between theories, approaches and institutions. With this relaunch (which combines Springer’s worldwide scientific scope with the Italian cultural roots of il Mulino and Fondazione Edison, whose research has been published by the two mentioned publishers for many years), the journal further reinforces its position in the European and international economic debate and scientific community. Furthermore, this move increases its pluralistic attention to the role that – at the micro, sectoral, and macro level – institutions and innovation play in the unfolding of economic change at different stages of development.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: