Research unbundling and market liquidity: Evidence from MiFID II

IF 3.1

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

Abstract

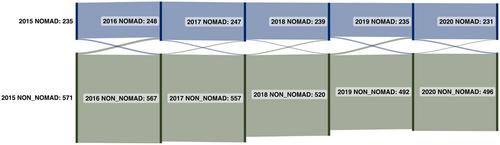

The second Markets in Financial Instruments Directive (MiFID II) mandated the unbundling of payments for research and trading. This research explores whether the impact of MiFID II differs between large and small firms in terms of analyst coverage and stock liquidity. Focusing on the UK stock markets we find a significant drop in analyst coverage on the Main Market, which leads to a deterioration in market liquidity. In contrast, the requirement of AIM firms to retain a Nominated Adviser, who often provides research coverage, has mitigated the impact of MiFID II.

研究松绑与市场流动性:MiFID II 提供的证据

第二部《金融工具市场指令》(MiFID II)规定对研究和交易费用进行分拆。本研究探讨了 MiFID II 在分析师覆盖率和股票流动性方面对大型公司和小型公司的影响是否有所不同。以英国股票市场为重点,我们发现主板市场的分析师覆盖率大幅下降,导致市场流动性恶化。相比之下,要求 AIM 公司保留提名顾问(通常提供研究覆盖面)的规定减轻了 MiFID II 的影响。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

European Financial Management

BUSINESS, FINANCE-

CiteScore

4.30

自引率

18.20%

发文量

60

期刊介绍:

European Financial Management publishes the best research from around the world, providing a forum for both academics and practitioners concerned with the financial management of modern corporation and financial institutions. The journal publishes signficant new finance research on timely issues and highlights key trends in Europe in a clear and accessible way, with articles covering international research and practice that have direct or indirect bearing on Europe.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: