Does climate change affect economic data?

IF 1.9

4区 经济学

Q2 ECONOMICS

引用次数: 0

Abstract

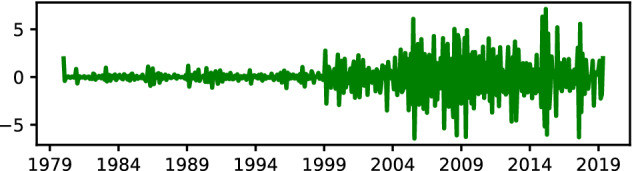

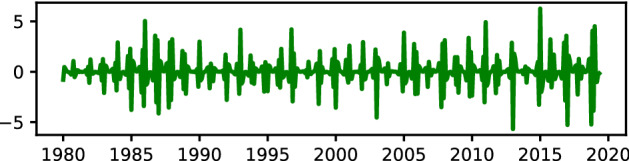

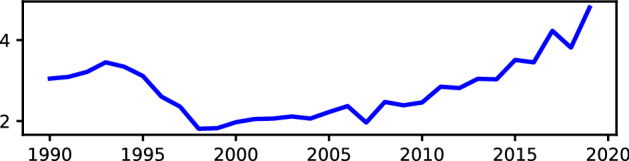

This paper derives the seasonal factors from the US temperature, gasoline price, and fresh food price data sets using the Kalman state smoother and the principal component analysis. Seasonality in this paper is modeled by the autoregressive process and added to the random component of the time series. The derived seasonal factors show a common feature: their volatilities have increased over the last four decades. Climate change is undoubtedly reflected in the temperature data. The three data sets' similar patterns from the 1990s suggest that climate change may have affected the prices' volatility behavior.

气候变化会影响经济数据吗?

本文使用卡尔曼状态平滑器和主成分分析,从美国气温、汽油价格和新鲜食品价格数据集中推导出季节性因素。本文中的季节性通过自回归过程建模,并添加到时间序列的随机分量中。衍生的季节性因素显示出一个共同的特征:在过去四十年中,它们的波动性增加了。气候变化无疑反映在温度数据中。这三个数据集在20世纪90年代的相似模式表明,气候变化可能影响了价格的波动行为。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Empirical Economics

Multiple-

CiteScore

4.40

自引率

0.00%

发文量

157

期刊介绍:

Empirical Economics publishes high quality papers using econometric or statistical methods to fill the gap between economic theory and observed data. Papers explore such topics as estimation of established relationships between economic variables, testing of hypotheses derived from economic theory, treatment effect estimation, policy evaluation, simulation, forecasting, as well as econometric methods and measurement. Empirical Economics emphasizes the replicability of empirical results. Replication studies of important results in the literature - both positive and negative results - may be published as short papers in Empirical Economics. Authors of all accepted papers and replications are required to submit all data and codes prior to publication (for more details, see: Instructions for Authors).The journal follows a single blind review procedure. In order to ensure the high quality of the journal and an efficient editorial process, a substantial number of submissions that have very poor chances of receiving positive reviews are routinely rejected without sending the papers for review.Officially cited as: Empir Econ

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: